GuruScreen Movers - May 5th: Focus on IPOs

Can investors take advantage of an IPO? IPOs only happen once for each company, so we may feel that they are 'once in a lifetime opportunities'. Some IPOs rocket and their share prices just keep rising. However, others enjoy an initial pop but then go on to massively underperform the market. How can investors separate the wheat from the chaff? Let's take a look at Stockopedia's GuruScreens to find out.

Do IPOs underperform?

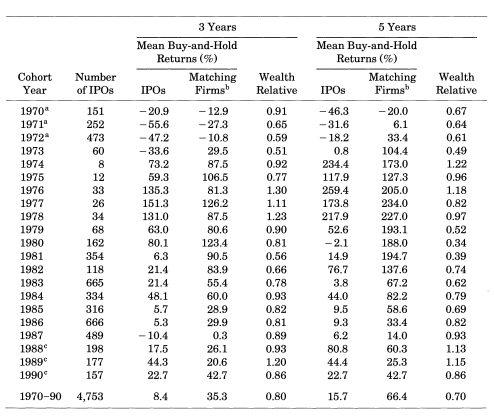

Research by a number academics shows that companies which have recently IPO'd tend to underperform the market. One study by US professors Tim Loughran and Jay Ritter found that:

Analysts have put forward numerous suggestions for why recent IPOs tend to underperform, including:

BooHoo (BOO) and AO World (AO.)

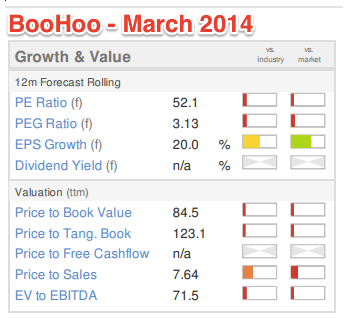

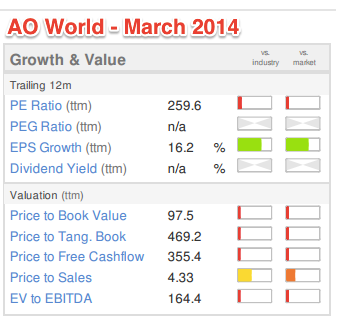

Online retailers BooHoo (BOO) and AO World (AO.) both IPO'd in early 2014. It is impossible to tell whether these companies decided to issue shares when they judged that the market was willing to overpay for their stock. However, when AO World first went public, it was one of the most expensive companies in the market, with an overall ValueRank of just 2. The Stockopedia ValueRank is a blend of several of the most important value ratios. Similarly, BooHoo had a ValueRank of just 3.

You can also see from the traffic lights (below) that when BooHoo and AO World were more expensive than their industry peers on a PE, PS and PB basis. This data corroborates research by Purnanandam and Swaminathan (2000), who suggest that 'the median IPO is overvalued by about 50% relative to its industry peers.'

What happened next? AO World dropped by 22%, while BooHoo has fallen by a colossal 60%.

So what went wrong?

AO World released a profit warning in early 2015. Similarly, back in January, BooHoo revealed that full-year results would come in below market expectations. Brokers are becoming increasingly pessimistic about these companies. Since April 2014, EPS estimates for BooHoo have fallen from 1.2p to 0.8p (see image). Furthermore, EPS estimates for AO World have fallen from 2.68p to 0.12p since April 2014.

It is also interesting to note that both companies currently qualify for Stockopedia's 'Unholy Trinity' Screen - a three point short selling screen based on the approach outlined by James Montier to identify potential candidates in weak markets.

Just Eat (JE.)

Just Eat is another company that IPO'd in the first half of 2014. Like BooHoo and AO World, Just Eat appears to be expensively priced on many metrics. It currently has a whopping PE ratio 125, well above the market average of 19. However, some investors like William O'Neil - author of How to Make Money in Stocks - tend to disregard traditional valuation measures like price-to-earnings ratios. O'Neil's studies of the market found that it was actually those companies that looked very expensive based on these measures that went on to be some of the greatest winners. Indeed, Just Eat has appreciated by a massive 60% since April 2014.

Just Eat currently qualifies for Stockopedia's William O'Neil screen, which aims to find stocks with fast earnings growth and share price momentum.

Conclusions

BooHoo and AO World have both underperformed the market since their IPO last year. However, Just Eat qualifies for Stockopedia's William O'Neil screen and has beaten the market by a large margin. In order to identify IPO winners, Stockopedia subscribers could filter the market using the GuruScreens. These are stock screens inspired by the strategy of a given Guru. Alternatively, users can hone in on good quality companies trading at bargain prices by exploring the StockRanks Portal. If you wanted to learn more about valuation tools, then Stockopedia's free ebooks are a good place to start.

Safe investing

Alex

Read More about Just Eat on Stockopedia

Discuss Just Eat on Stockopedia

Yahoo Finance

Yahoo Finance