GuruScreens - upgrades and downgrades - January 13th: DPZ; ASC; CINE.

Cineworld

Revenues at Cineworld, the largest cinema operator in the UK, have grown by 16% over the last twelve months, supported by the acquisition of Cinema City - an east European cinema chain that should provide scope for overseas growth. Analysts expect earnings to grow by another 18% over the next twelve months as Cineworld's management team anticipate strong box office performances from films like 'The Hunger Games' and 'The Hobbit: The Battle of the Five Armies'.

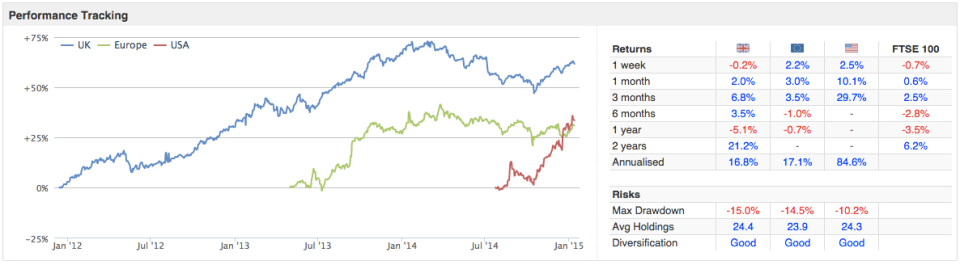

The market is becoming increasingly optimistic about this company. Cineworld has beaten the market by 30% over the last three months and 12% over the last year (as you can see from the company's StockReport). The company also trades just 1% below its 52 week high and recently qualified for Stockopedia's 52 Week High Momentum Screen. In the UK, stocks which have qualified for this screen appreciated, on average, by 7% over the last three months while the FTSE 100 rose by just 2.5% (see below).

Papa John's Pizza

In the US, the 52 Week High Momentum Screen has returned a blistering 29% over the last three months. One of the companies that recently qualified for this screen is Papa John's Pizza, which operates and franchises pizza delivery and carryout restaurants. Earnings at this company have growth each year, without fail, since 2009. Furthermore, revenues have grown by around 50% since 2009 and by 8% over the last twelve months. The growth has been supported by international expansion, particularly in the UK and China.

Papa John's is the fourth largest pizza chain in the United States, able to run its business on an economy of scale basis. The company has a ROCE (Return on Capital Employed) of 28% - higher than 95% of US companies. The company also has an overall QualityRank of of 87, compared to Domino Pizza's QualityRank of 75 (see Compare tool below).

True, Papa John's ValueRank is now 23 - suggesting that the company could be overvalued. However, the firm has a high QualityRank (87) and a strong MomentumRank (97). This is important because a large body of academic research has shown that good quality stocks have had a historical tendency to beat junk stocks. Furthermore, stocks like to ignore the laws of gravity. Trends tend to persist. Stocks that go up have had a tendency to keep on going up.

ASOS

Is ASOS manipulating its earnings? It recently qualified for the James Montier 'Cooking the Books' Screen. Montier created the C-Score in attempt to create a scoring system that highlighted companies which may be 'cooking the books'. The C-Score measures six inputs including the divergence between net income and cash-flow. Companies which qualify for the Montier screen have a P/S ratio above 2 and a C-Score equal or above 5.

If you bought shares in ASOS at around 120p back in 2007, the value of those shares would have increased nearly 58-fold by the time ASOS's share price peaked at £70.07 in February 2014. However, the company has underperformed the market by a staggering 63% over the last year. The brokers are also becoming less optimistic about this company. The EPS estimate has fallen from 89p (Jan 2014) to 42p (Jan 2015). Nevertheless, ASOS still trades on a PE multiple of 58.

Read More about ASOS on Stockopedia

Discuss ASOS on Stockopedia

Yahoo Finance

Yahoo Finance