GW Pharmaceuticals (NASDAQ:GWPH) Shareholders Have Enjoyed A 43% Share Price Gain

GW Pharmaceuticals plc (NASDAQ:GWPH) shareholders might be concerned after seeing the share price drop 26% in the last quarter. On the bright side the share price is up over the last half decade. However we are not very impressed because the share price is only up 43%, less than the market return of 67%.

Check out our latest analysis for GW Pharmaceuticals

GW Pharmaceuticals isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years GW Pharmaceuticals saw its revenue grow at 27% per year. That's well above most pre-profit companies. It's nice to see shareholders have made a profit, but the gain of 7.4% over the period isn't that impressive compared to the overall market. That's surprising given the strong revenue growth. Arguably this falls in a potential sweet spot - modest share price gains but good top line growth over the long term justifies investigation, in our book.

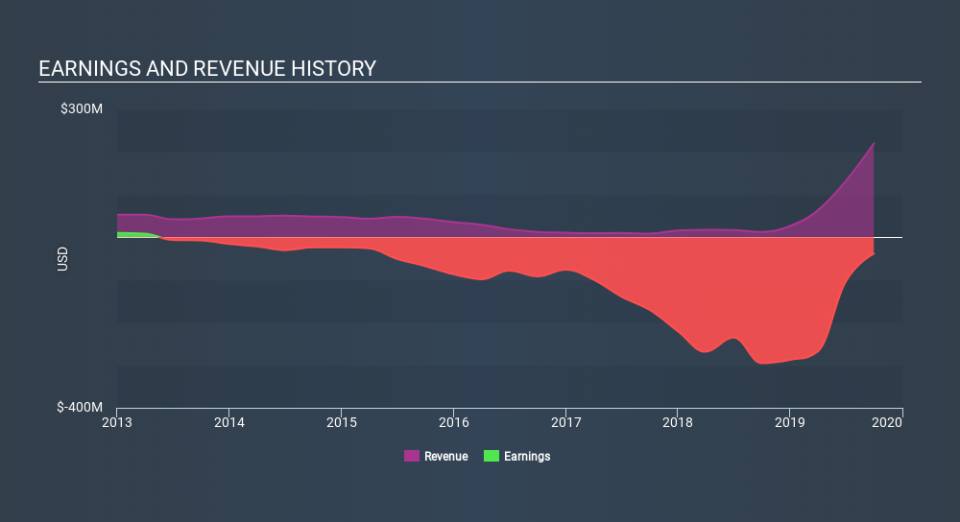

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on GW Pharmaceuticals

A Different Perspective

Investors in GW Pharmaceuticals had a tough year, with a total loss of 17%, against a market gain of about 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 7.4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You could get a better understanding of GW Pharmaceuticals's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: GW Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance