If You Had Bought Amsterdam Commodities (AMS:ACOMO) Stock Three Years Ago, You'd Be Sitting On A 30% Loss, Today

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Amsterdam Commodities N.V. (AMS:ACOMO) shareholders have had that experience, with the share price dropping 30% in three years, versus a market decline of about 1.5%. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days. Of course, this share price action may well have been influenced by the 15% decline in the broader market, throughout the period.

Check out our latest analysis for Amsterdam Commodities

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

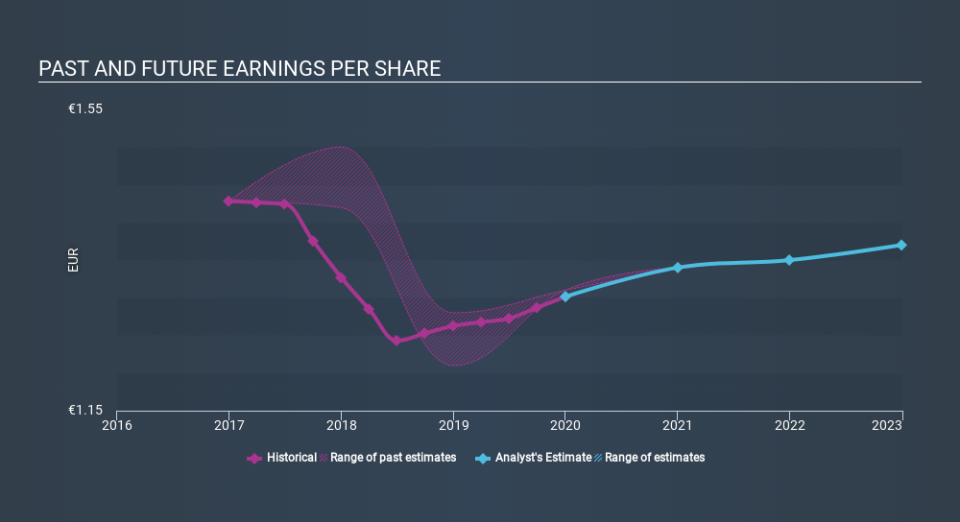

Amsterdam Commodities saw its EPS decline at a compound rate of 3.1% per year, over the last three years. The share price decline of 11% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Amsterdam Commodities's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Amsterdam Commodities's TSR for the last 3 years was -19%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Although it hurts that Amsterdam Commodities returned a loss of 3.7% in the last twelve months, the broader market was actually worse, returning a loss of 14%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 1.2% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Amsterdam Commodities better, we need to consider many other factors. For instance, we've identified 2 warning signs for Amsterdam Commodities (1 makes us a bit uncomfortable) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance