If You Had Bought Colfax (NYSE:CFX) Stock Five Years Ago, You'd Be Sitting On A 36% Loss, Today

It is doubtless a positive to see that the Colfax Corporation (NYSE:CFX) share price has gained some 32% in the last three months. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 36% in that half decade.

View our latest analysis for Colfax

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Colfax moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

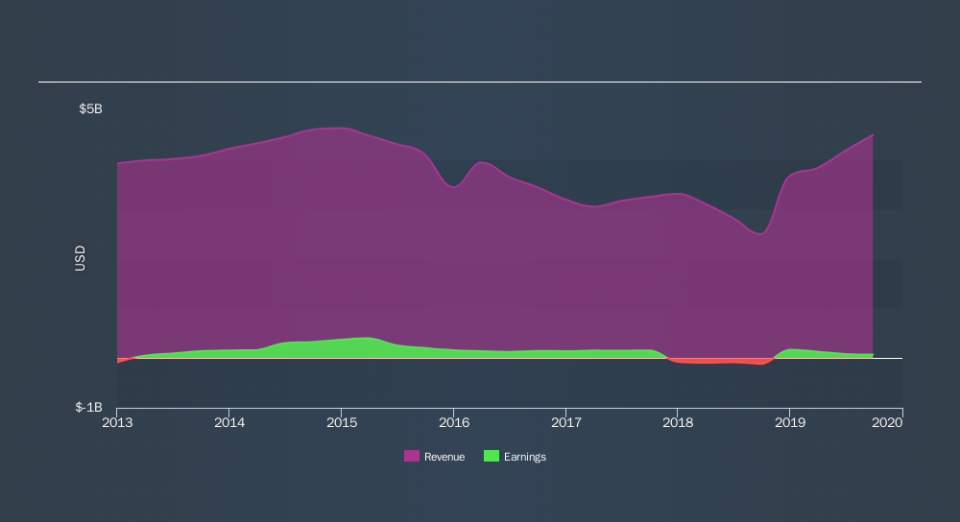

It could be that the revenue decline of 4.6% per year is viewed as evidence that Colfax is shrinking. This has probably encouraged some shareholders to sell down the stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Colfax is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Colfax will earn in the future (free analyst consensus estimates)

A Different Perspective

It's good to see that Colfax has rewarded shareholders with a total shareholder return of 22% in the last twelve months. Notably the five-year annualised TSR loss of 8.5% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance