If You Had Bought Corero Network Security (LON:CNS) Stock Five Years Ago, You'd Be Sitting On A 70% Loss, Today

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Corero Network Security plc (LON:CNS) for five whole years - as the share price tanked 70%. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days.

Check out our latest analysis for Corero Network Security

Because Corero Network Security is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Corero Network Security grew its revenue at 0.6% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 21%, compound, over five years) suggests the market is very disappointed with this level of growth. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

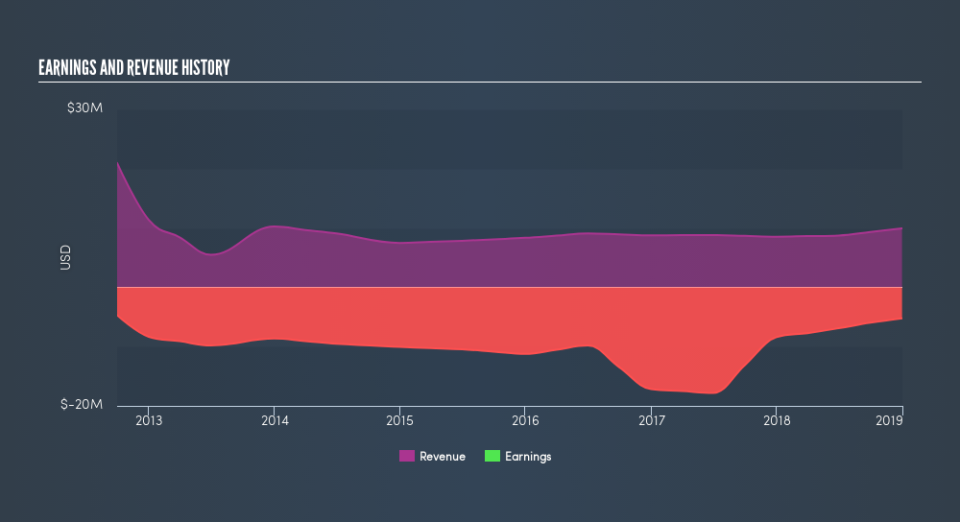

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Corero Network Security's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Corero Network Security had a tough year, with a total loss of 4.5%, against a market gain of about 3.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 21% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Corero Network Security may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance