If You Had Bought Homology Medicines' (NASDAQ:FIXX) Shares Three Years Ago You Would Be Down 67%

If you love investing in stocks you're bound to buy some losers. But long term Homology Medicines, Inc. (NASDAQ:FIXX) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 67% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 55% lower in that time. Furthermore, it's down 36% in about a quarter. That's not much fun for holders.

See our latest analysis for Homology Medicines

Homology Medicines isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Homology Medicines saw its revenue grow by 69% per year, compound. That is faster than most pre-profit companies. In contrast, the share price is down 19% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

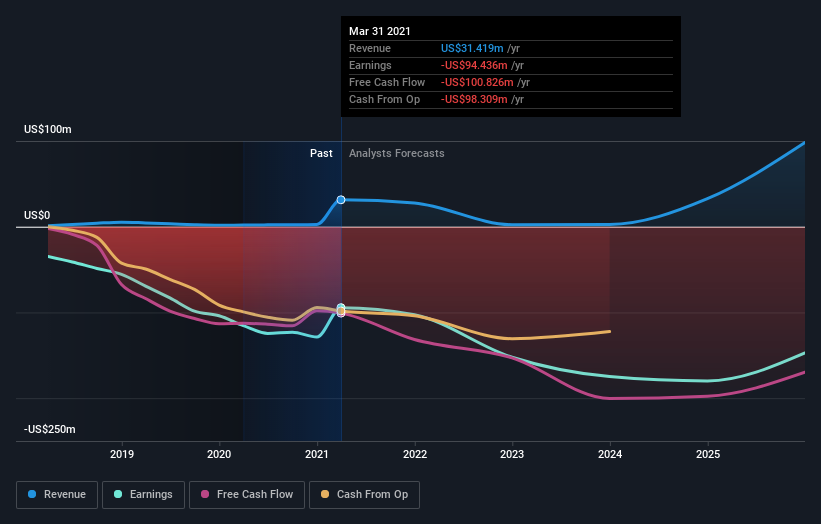

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Homology Medicines

A Different Perspective

Homology Medicines shareholders are down 55% for the year, but the broader market is up 42%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 19% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Homology Medicines (including 1 which shouldn't be ignored) .

But note: Homology Medicines may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance