If You Had Bought International Petroleum's (TSE:IPCO) Shares Three Years Ago You Would Be Down 61%

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term International Petroleum Corporation (TSE:IPCO) shareholders. Sadly for them, the share price is down 61% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 53% lower in that time. Furthermore, it's down 18% in about a quarter. That's not much fun for holders.

See our latest analysis for International Petroleum

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

International Petroleum became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 29% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching International Petroleum more closely, as sometimes stocks fall unfairly. This could present an opportunity.

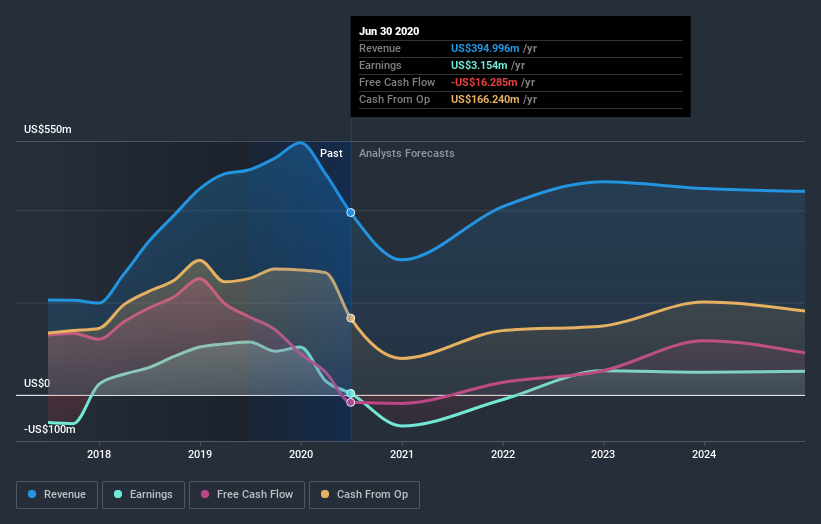

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that International Petroleum has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on International Petroleum's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for International Petroleum shares, which performed worse than the market, costing holders 53%. The market shed around 2.1%, no doubt weighing on the stock price. The three-year loss of 17% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with International Petroleum (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

But note: International Petroleum may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance