If You Had Bought J D Wetherspoon (LON:JDW) Shares Five Years Ago You'd Have Earned 65% Returns

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the J D Wetherspoon share price has climbed 65% in five years, easily topping the market return of 20% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 12%.

See our latest analysis for J D Wetherspoon

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

J D Wetherspoon's earnings per share are down 39% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

The revenue reduction of 4.0% per year is not a positive. It certainly surprises us that the share price is up, but perhaps a closer examination of the data will yield answers.

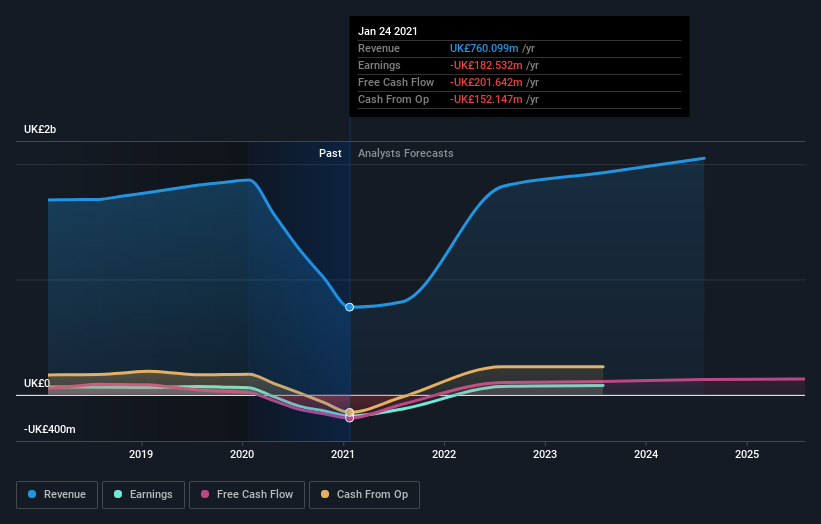

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

J D Wetherspoon is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What about the Total Shareholder Return (TSR)?

We've already covered J D Wetherspoon's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that J D Wetherspoon's TSR of 71% over the last 5 years is better than the share price return.

A Different Perspective

J D Wetherspoon provided a TSR of 12% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 11% over half a decade This suggests the company might be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with J D Wetherspoon .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance