If You Had Bought Purplebricks Group (LON:PURP) Stock Three Years Ago, You'd Be Sitting On A 84% Loss, Today

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of Purplebricks Group plc (LON:PURP) investors who have held the stock for three years as it declined a whopping 84%. That would be a disturbing experience. And more recent buyers are having a tough time too, with a drop of 65% in the last year. Furthermore, it's down 63% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 32% decline in the broader market, throughout the period.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Purplebricks Group

Purplebricks Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

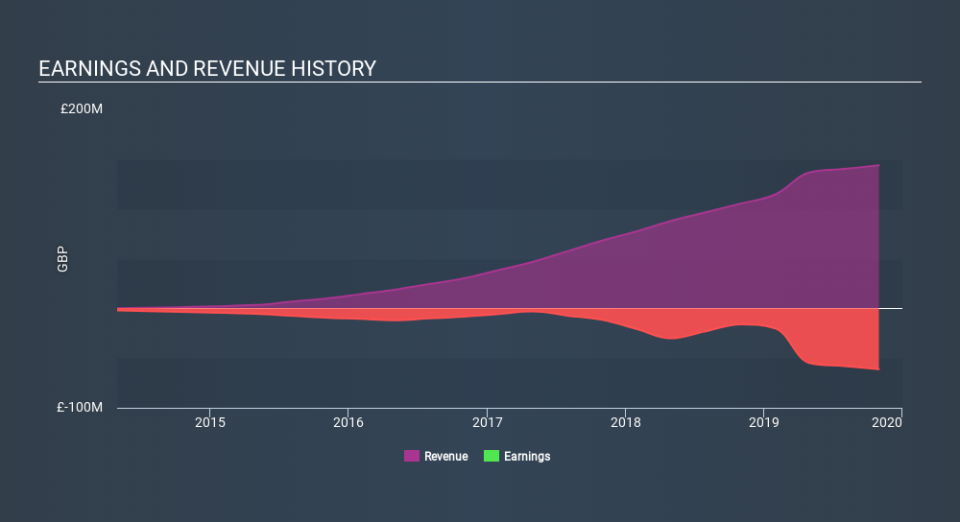

Over three years, Purplebricks Group grew revenue at 45% per year. That is faster than most pre-profit companies. So why has the share priced crashed 46% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Purplebricks Group shareholders are down 65% for the year, falling short of the market return. The market shed around 23%, no doubt weighing on the stock price. The three-year loss of 46% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Purplebricks Group has 3 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance