If You Had Bought Semperit Holding (VIE:SEM) Stock Five Years Ago, You'd Be Sitting On A 72% Loss, Today

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the Semperit Aktiengesellschaft Holding (VIE:SEM) share price managed to fall 72% over five long years. That's an unpleasant experience for long term holders. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days. Of course, this share price action may well have been influenced by the 24% decline in the broader market, throughout the period.

See our latest analysis for Semperit Holding

Semperit Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Semperit Holding saw its revenue shrink by 0.5% per year. While far from catastrophic that is not good. If a business loses money, you want it to grow, so no surprises that the share price has dropped 22% each year in that time. We're generally averse to companies with declining revenues, but we're not alone in that. That is not really what the successful investors we know aim for.

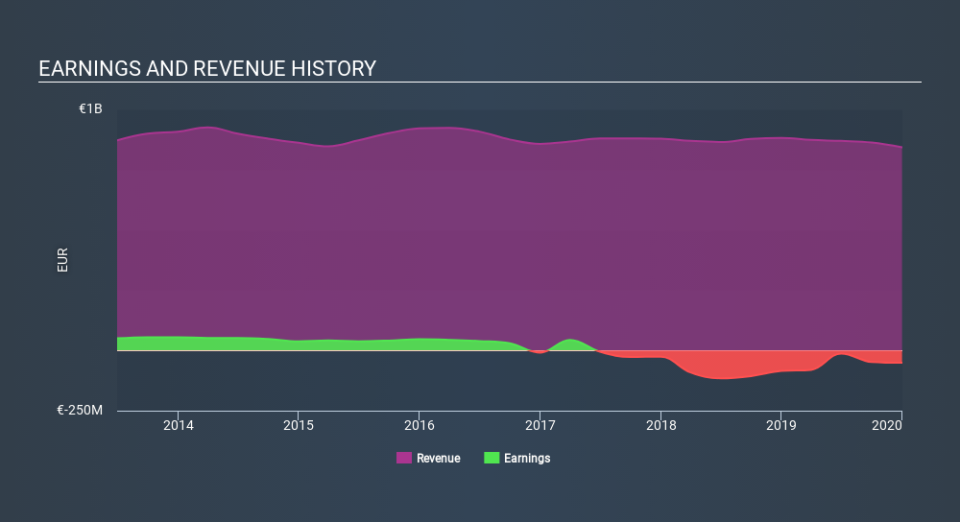

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The total return of 18% received by Semperit Holding shareholders over the last year isn't far from the market return of -19%. Worse still, the company has lost shareholders 21% per year over five years. It could well be that the business has begun to stabilize, although we'd be hesitant to buy without clear information suggesting the company will grow. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Semperit Holding (of which 1 makes us a bit uncomfortable!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance