If You Had Bought Veoneer (NYSE:VNE) Stock A Year Ago, You'd Be Sitting On A 55% Loss, Today

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held Veoneer, Inc. (NYSE:VNE) over the last year knows what a loser feels like. To wit the share price is down 55% in that time. Because Veoneer hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

View our latest analysis for Veoneer

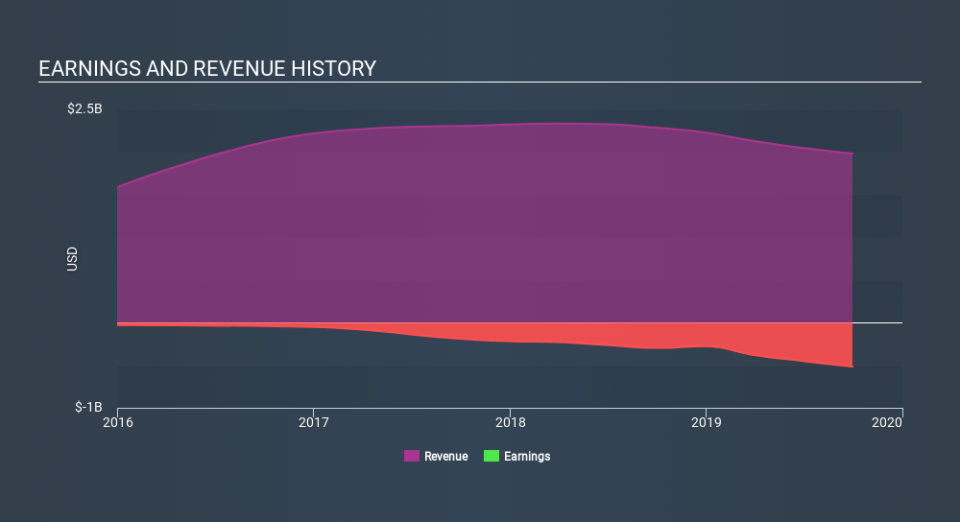

Because Veoneer made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Veoneer's revenue didn't grow at all in the last year. In fact, it fell 13%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 55%. Fingers crossed this is the low ebb for the stock. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Veoneer is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While Veoneer shareholders are down 55% for the year, the market itself is up 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 18% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Veoneer that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance