Shopping centre owner Hammerson collects just 41% of September rents

Hammerson (HMSO.L), the owner of shopping centres such as Brent Cross in London and Bicester Village in Oxfordshire, said on Thursday it had managed to collect just 41% of rents due for the fourth quarter.

Hammerson said it had collected 38% of September rents in the UK, 33% of rents due in Ireland, and 51% in France. The low collection rates come despite all its shopping centres reopening and 94% of its retail tenants reopening — 99% are open in France.

The company said the shortfall was due to “a combination of rent deferrals, moving to monthly payments, and in some cases waivers, particularly for smaller and independent brands.”

Hammerson pointed out that the fourth quarter rent figure compared favourably to its third quarter performance. The company managed to collect just 16% of third quarter dues on its first attempt.

READ MORE: Pub chain Marston's blames new curbs as it axes 2,150 furloughed staff

The company has now collected 59% of third quarter rents and 66% of all rent due so far this year.

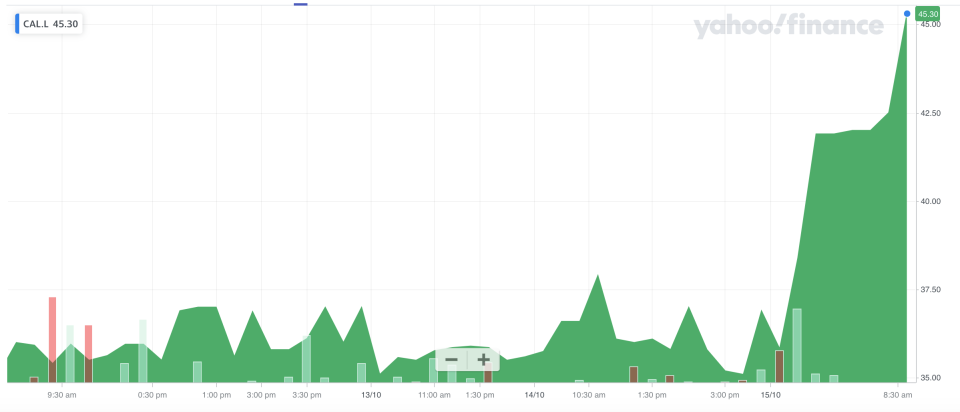

However, rivals are faring better. Capital & Regional (CAL.L), which owns seven shopping centres mainly under “The Mall” brand, said on Thursday it had collected 51% of fourth quarter rents. British Land (BLND.L) said last week it had collected 50% of September retail rents.

“Feedback from our retailers indicates that average transaction values are registering higher than the comparable period last year, with shopper visits being purpose driven,” said Lawrence Hutchings, chief executive of Capital & Regional, in a statement on Thursday.

Shares in Hammerson fell 3%, while Capital & Regional rose 15%.

Shares in Hammerson have fallen almost 90% so far this year as national lockdowns have devastated the in-person retail sector. Rival shopping centre operator Intu, which owned the Trafford Centre in Manchester, collapsed into administration in June.

Land Securities (LAND.L), which owns both offices and retail space, said last week it had managed to collect just 33% of September’s quarterly rents from its retail tenants.

WATCH: What is the bounce back loan scheme?

Yahoo Finance

Yahoo Finance