Hardly anyone is betting on a V-shaped recovery: Morning Brief

Wednesday, May 20, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

Investors are placing big bets on a vaccine

Federal Reserve Chair Jerome Powell told “60 Minutes” on Sunday that he is aware of the letters.

V. L. W. U. M. A Nike “swoosh,” and so on.

All of these letters and shape outline potential paths for the post-pandemic economic recovery.

“People are fascinated by the possibility of different letters,” Powell told Scott Pelley.

“And it's, again, really hard to say because it depends so much on the path of the virus. I will say that it's a reasonable assumption that the economy will begin to recover in the second half of the year, that unemployment will move down, that economic activity will pick up.”

But the “shape” this recovery will take is nevertheless a top-of-mind concern for investors, especially given the market’s recent rally. And these letters are, after all, the simplest framework for many folks trying to understand what the incredibly uncertain future might look like.

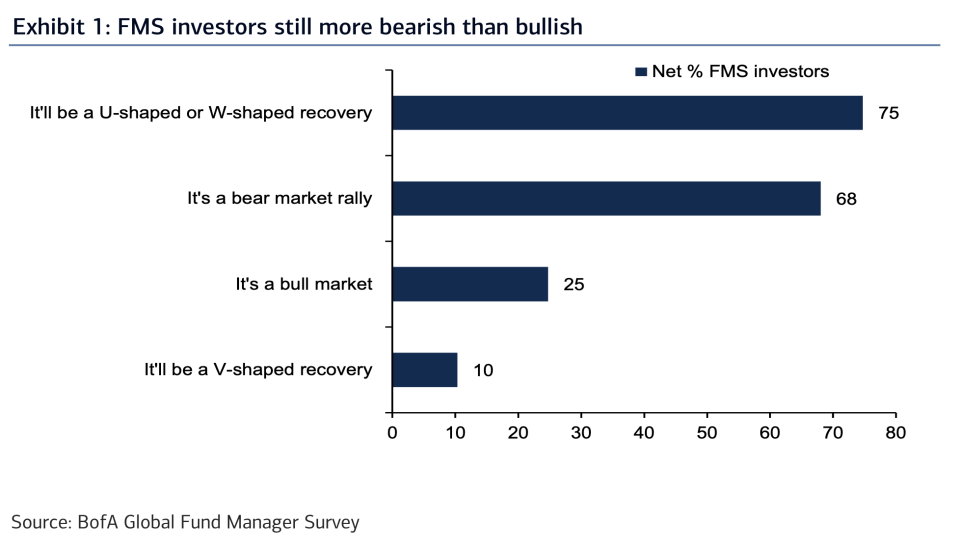

In its latest global fund manager survey, the team at Bank of America Global Research put this question to 194 participants with over $500 billion under management and the results were clear — hardly anyone is betting on a V-shaped recovery.

“Just 10% [of respondents] expect a V-shaped recovery,” BofA said in its note, adding that just 25% of respondents believe this current rally is part of a new bull market.

As BofA said succinctly: “Zeitgeist bearish.”

Currently, 75% of respondents expect the recovery will be a U or W shaped and 68% of respondents think what we’re seeing the stock market right now is a bear market rally.

Given the speed and persistence of the market’s move off its March 23 lows, that most investors remain cautious on the economic outlook might be surprising. Though it depends on how you see the world.

On the one hand, there’s a cliché which says the stock market is supposed to inflict the most pain on the largest number of participants for as long as possible. Stocks rallying amid a bearish outlook, in this world, makes total sense.

But as Sam Ro highlighted in yesterday’s Morning Brief, investors seem to be finding a bullish case not in what’s happening economically but in what could happen with the virus. And specifically, finding a vaccine for COVID-19.

According to a survey from Deutsche Bank, 74% of investors surveyed by the firm think there will be some form of a vaccine for COVID-19 within 18 months. And while experts have tried to temper some enthusiasm around these unprecedented timelines for vaccine development, it’s clear that investors are significantly motivated by even just the potential for positive breakthroughs regarding a treatment for the virus.

As Morgan Stanley analysts outlined in a recent note to clients, even if a safe vaccine is found in short order significant challenges remain around manufacturing and distribution.

What the market’s recent action — including Monday’s huge rally — suggests, however, is that identifying a vaccine could be enough to make consumers and businesses confident they can continue the process of finding a new economic normal.

And as BofA’s survey also finds, the catalyst that could make a V-shaped recovery possible isn’t more action from Congress or the Fed, but a breakthrough on a COVID-19 vaccine.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

7 a.m. ET: MBA Mortgage Applications, week ending May 15 (+0.3% prior)

Earnings

Pre-market

6 a.m. ET: Lowe’s (LOW) is expected to report adjusted earnings of $1.29 per share on $18.29 billion in revenue

6:30 a.m. ET: Target (TGT) is expected to report adjusted earnings of 45 cents per share on $18.75 billion in revenue

Post-market

4 p.m. ET: Expedia (EXPE) is expected to report an adjusted loss of $1.43 per share on $2.11 billion in revenue

4:05 p.m. ET: Take-Two Interactive (TTWO) is expected to report adjusted earnings of 89 cents per share on $585.14 million in revenue

Top News

Johnson & Johnson to stop selling talc-based Johnson's Baby Powder in U.S., Canada [Reuters]

Luckin’s stock faces wipeout in rush to sell before delisting [Bloomberg]

Lockdown pushes UK inflation rate to lowest level in four years [Yahoo Finance UK]

TikTok owner’s value surpasses $100B in private markets [Bloomberg]

YAHOO FINANCE HIGHLIGHTS

Over 4 million in US will contract coronavirus if states fully reopen: Wharton model

FAANG stocks are totally ignoring the COVID-19 pandemic and are approaching this stunning level

Walmart has been selling a lot of adult bicycles and sewing machines during the coronavirus pandemic

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance