Coronavirus: Recruiter Hays has shed 1,000 jobs as vacancies dry up

The recruitment giant Hays (HAS.L) has shed more than 1,000 staff in the past few months, as hiring has seized up in the wake of the coronavirus and lockdowns around the world.

Hays, a UK-listed firm with operations in 33 countries, announced in a trading update its net fees had dived 34% year-on-year in the quarter to 30 June. It said staff numbers had fallen by 9% on the quarter to around 10,400 employees. Its shares slid more than 4% on the announcement on Thursday.

In the UK and Ireland, its income took a greater hit in “extremely tough market conditions” but consultant job cuts were less severe than elsewhere. Net fees slid 42% as both temp and permanent recruitment dried up, with private sector recruitment falling further than in the public sector. Consultant staff numbers fell 7% on the quarter.

Hays’ income dropped less sharply in London, its largest region, than the average for the UK as a whole. The sectors worst hit included accountancy, finance and office support, construction and property, with fees more than halving on a year earlier. Life sciences was the only sector recording growth, up 25% and “benefiting from some additional COVID-19 contract work.”

READ MORE: UK employers have shed almost 650,000 jobs since March

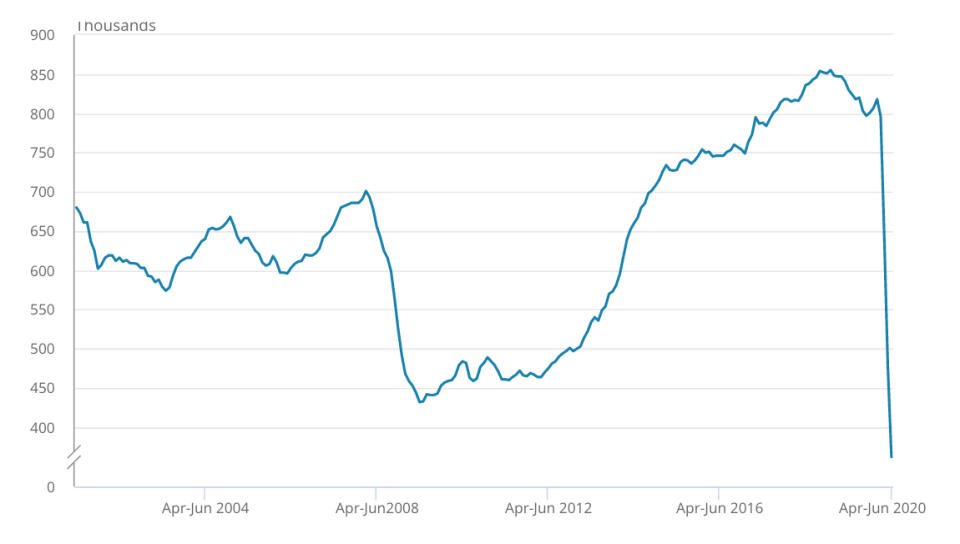

Official figures on Thursday showed UK vacancies between April and June at their lowest levels since records began in 2001. The Office for National Statistics (ONS) data showed a slight uptick in job ads in June, however, as Britain’s lockdown continued to ease.

“One concerning trend is that hiring in the UK isn’t gathering the same momentum as in other markets and compared to G7 economies, the UK lags a long way behind,” said Jack Kennedy, UK economist at the global job site Indeed.

It comes a week after two of Hays’ rivals confirmed they had shed more than 780 jobs between them and slashed a fifth of their costs in recent months. PageGroup and Robert Walters both reported sharp drops in gross profit last Wednesday (8 July). Both have operations worldwide.

At PageGroup (PAGE.L) profits slid by 47.4% in its second quarter year-on-year to £118.3m ($149.5m). It confirmed its staff numbers had dropped by 255 people in April and a further 326 in May and June, with its fee-earning recruiters dropping mainly in the UK and Americas.

READ MORE: PageGroup and Robert Walters slash jobs and costs

PageGroup said most of its cuts to fee-earning staff had affected “inexperienced” recent joiners and staff on performance review. But it said it was still “selectively hiring experience fee earners from the competition at all levels,” and had received unprecedented application numbers.

Rival Robert Walters (RWA.L) saw its group profits slide 34% year-on-year to £71.1m. It told investors its staff numbers were down by 5% on levels at the end of March, falling to 3,734.