Healthpeak Properties Inc (DOC) Q1 2024 Earnings: Modest Gains Amid Strategic Expansions

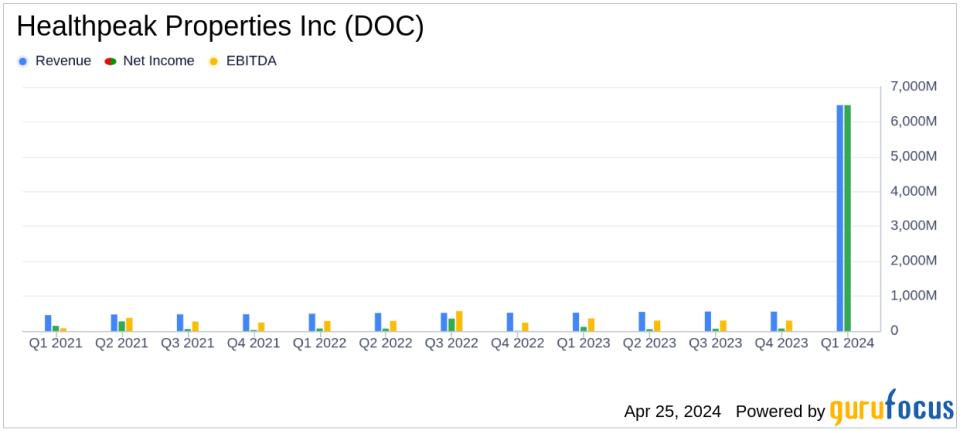

Net Income: $6.477M, significantly decreased from $117.698M in the previous year.

Diluted Earnings Per Share: $0.01, down from $0.22 year-over-year.

Total Revenue: $606.56M, up from $525.678M year-over-year.

Dividend Declared: Quarterly common stock cash dividend of $0.30 per share, payable on May 17, 2024.

Share Repurchase: Repurchased 5.8 million shares for approximately $100 million under the $500 million share repurchase program.

Merger-Combined Same-Store Cash NOI Growth: Increased by 4.5% year-over-year.

2024 Guidance: Increased diluted earnings per share guidance to $0.16 - $0.20 and FFO as Adjusted per share to $1.76 - $1.80.

On April 25, 2024, Healthpeak Properties Inc (NYSE:DOC), a prominent real estate investment trust specializing in healthcare properties, disclosed its financial results for the first quarter ended March 31, 2024. The company announced a net income of $0.01 per share and declared a quarterly cash dividend on common stock. This financial update, detailed in their recent 8-K filing, reflects a nuanced picture of modest gains paired with strategic expansions and operational adjustments.

Healthpeak Properties owns a diversified healthcare portfolio, including approximately 459 properties primarily focused on medical office and life science assets. The company's strategic initiatives, such as the internalization of property management and significant lease executions, underscore its operational focus and growth trajectory in the healthcare real estate sector.

Quarterly Performance Highlights

The first quarter of 2024 saw Healthpeak reporting a diluted net income of $0.01 per share, a stark decline from the $0.22 reported in the same period last year. Despite this, the company achieved a Nareit FFO of $0.27 per share and an AFFO of $0.41 per share, indicating resilient operational performance. The Total Merger-Combined Same-Store Cash (Adjusted) NOI growth was reported at 4.5%, reflecting positive momentum in core operations.

Healthpeak's strategic activities included the execution of new and renewal leases totaling 1.6 million square feet, with significant expansions in outpatient medical and lab spaces. These efforts are part of a broader strategy to enhance portfolio quality and tenant diversification, which is crucial for long-term value creation in the REIT sector.

Financial and Strategic Developments

During the quarter, Healthpeak made notable progress in its merger integration with Physicians Realty Trust, forecasting year-one merger-related synergies of $45 millionan increase from previous estimates. This integration is pivotal for Healthpeak, potentially leading to enhanced operational efficiencies and a stronger market presence.

The company also reported significant property dispositions and loan repayments, which collectively amounted to over $430 million. These transactions are part of Healthpeak's capital recycling strategy, aimed at strengthening the balance sheet and focusing on high-potential market segments.

In terms of capital market activities, Healthpeak secured a new $750 million term loan, fixing the interest rate at 4.5% for five years, thereby stabilizing its financial outlook against potential interest rate volatility. Additionally, the company repurchased $100 million of common stock, underscoring its commitment to shareholder value.

Challenges and Forward-Looking Statements

Despite these positive developments, Healthpeak faces challenges, including the fluctuating economic environment and the ongoing need to adapt to the rapidly evolving healthcare industry. The company's ability to maintain occupancy rates, manage costs effectively, and navigate regulatory landscapes will be crucial in sustaining growth and profitability.

Looking ahead, Healthpeak has updated its full-year 2024 guidance, reflecting a cautious yet optimistic outlook. The company now expects diluted earnings per share to range between $0.16 and $0.20 and has made upward adjustments to its FFO as Adjusted and AFFO per share forecasts.

As Healthpeak continues to navigate the complexities of the healthcare real estate market, its focus on strategic growth, operational efficiency, and financial prudence will be key to achieving long-term success and delivering value to its shareholders.

Explore the complete 8-K earnings release (here) from Healthpeak Properties Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance