Hedge fund circles British Airways owner

One of Britain’s most powerful hedge funds has taken a major stake in the owner of British Airways as the flag carrier braces for a turbulent winter.

Marshall Wace - which has bet against the fortunes of bailed-out airlines on the Continent and is linked with plans to extend the northern runway at Heathrow - has built a 3pc stake in IAG worth about £140m.

The disclosure comes 48 hours after BA boss Alex Cruz stepped down, and catapults the Mayfair fund into the ranks of IAG’s biggest investors.

State-owned Qatar Airways is the largest shareholder in the airline firm with a 25pc stake.

Marshall Wace entered into “big shorts” against the likes of Air France KLM and Lufthansa earlier this year as the coronavirus crisis gripped the aviation industry.

With all but a handful of flights grounded after Covid brought a golden age of air travel to a crashing halt, Franco-Dutch company Air France KLM received €10bn (£9bn) in state aid over summer. Berlin handed Lufthansa a €9bn bailout.

In contrast Chancellor Rishi Sunak has resisted calls to rescue airlines with taxpayer cash, insisting this will only be considered “as a last resort, having exhausted other options”.

A plea for £500m from Sir Richard Branson to rescue Virgin Atlantic was snubbed by the Treasury, forcing the businessman to defy his critics and mastermind a private-led restructuring of the airline’s finances.

IAG secured £300m from an emergency Bank of England loan scheme to help the largest companies get through the pandemic.

The FTSE 100 business then completed a £2.5bn rights issue last month ahead of the typically loss-making winter period.

Hopes of a recovery in air travel in the run-up to Christmas have been dashed after travel restrictions - relaxed over the summer - were tightened again when a second wave of Covid hit.

Marshall Wace fund manager Anthony Clake has separately backed a rival plan to expand Heathrow airport.

Instead of building a third runway, his "Heathrow Hub" proposes a piecemeal development by more efficiently using the existing infrastructure.

Last week the Supreme Court considered an appeal by Heathrow after the third runway was blocked by judges over environmental concerns. A ruling is expected in the coming weeks.

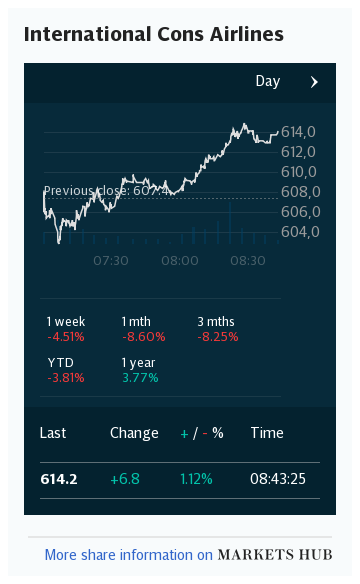

Shares in IAG closed 0.6pc higher at 98.2p. The stock was at 256p at the start of the year.

Yahoo Finance

Yahoo Finance