Helen Of Troy Ltd (HELE) Q4 Earnings: Adjusted EPS Surpasses Analyst Expectations

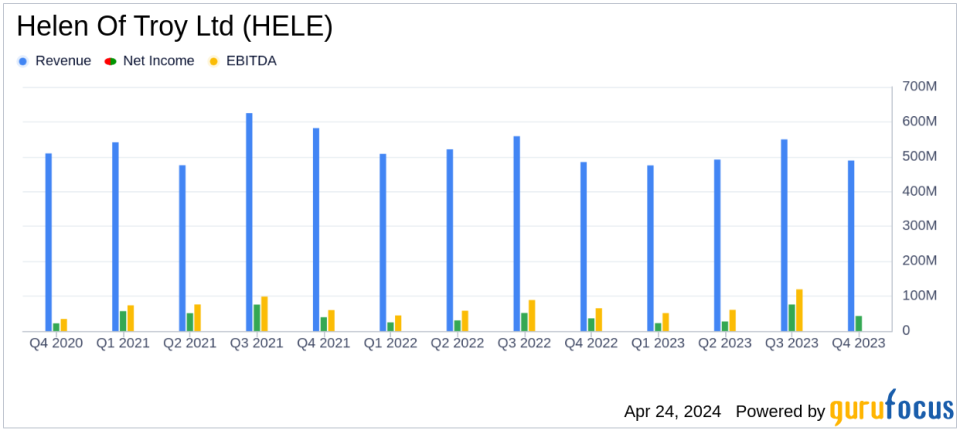

Revenue: Reported $489.2 million, a 1.0% increase year-over-year, surpassing estimates of $476.90 million.

Adjusted Diluted EPS: Achieved $2.45, reflecting a 21.9% growth from the previous year, exceeding the estimate of $2.30.

Net Income: Reached $42.7 million, up 18.1% year-over-year, surpassing estimates of $54.83 million.

Gross Profit Margin: Improved significantly by 570 basis points to 49.0% from 43.3% in the prior year.

Operating Margin: Expanded by 240 basis points to 13.5%, indicating improved operational efficiency.

Adjusted EBITDA: Grew by 28.4% to $94.3 million, with the margin expanding by 410 basis points to 19.3%.

Free Cash Flow: Reported substantial growth to $269.4 million for the fiscal year, compared to $33.4 million in the previous year.

Helen Of Troy Ltd (NASDAQ:HELE) released its 8-K filing on April 24, 2024, detailing solid performance for the fourth quarter of fiscal year 2024. The company, a leading global designer, developer, and marketer of branded consumer products, reported a consolidated net sales growth of 1.0% and a notable increase in both GAAP and adjusted diluted EPS.

Financial Performance Highlights

Helen Of Troy's fourth quarter saw consolidated net sales revenue of $489.2 million, a modest increase from the previous year, driven by organic growth in the Home & Outdoor and Beauty & Wellness segments. The company achieved a GAAP diluted EPS of $1.79, up from $1.50 in the prior year, and an adjusted diluted EPS of $2.45, exceeding the analyst estimate of $2.30 and up from $2.01 in the prior year. This performance reflects a strong operational execution with gross profit margin improvement and expanded adjusted EBITDA margins.

The company's net income for the quarter stood at $42.7 million, showing an 18.1% increase year-over-year. This improvement was supported by higher operating income across both major segments, reduced interest expenses, and a more favorable tax environment compared to the previous year.

Annual Financial Review

For the fiscal year 2024, Helen Of Troy reported consolidated net sales revenue of $2.005 billion, a decrease of 3.3% from the previous year, impacted by various external challenges. However, the company managed to improve its gross profit margin by 390 basis points to 47.3%. The annual net income saw a significant rise to $168.6 million, up 17.7% from the previous year, driven by robust operational improvements and cost management strategies.

Operational and Segment Insights

The Home & Outdoor segment reported a revenue increase of 5.4% to $223.3 million, primarily driven by strong demand in the brick and mortar and club channels, and notable international growth. Conversely, the Beauty & Wellness segment faced a slight revenue decline of 2.5% to $265.9 million, mainly due to lower sales in air purifiers, fans, and heaters, and a below-average illness incidence during the cough/cold/flu season.

Operational efficiency improvements were evident with the company's strategic initiatives such as Project Pegasus, which aims to enhance overall efficiency and reduce costs. This restructuring plan is expected to deliver substantial operating profit improvements by the end of fiscal 2027.

Looking Forward: Fiscal 2025 Outlook

For fiscal 2025, Helen Of Troy anticipates consolidated net sales between $1.965 billion and $2.025 billion, reflecting the ongoing challenges in consumer spending. The company projects a GAAP diluted EPS range of $6.68 to $7.45 and an adjusted diluted EPS range of $8.70 to $9.20. This outlook considers the expected benefits from operational efficiency projects and planned investments in growth and technology under the "Elevate for Growth" strategy.

In conclusion, Helen Of Troy Ltd demonstrated resilience and strategic agility in navigating a challenging market landscape. With a focus on operational excellence and consumer-centric innovations, the company is well-positioned to sustain its growth trajectory and enhance shareholder value in the upcoming fiscal year.

For detailed financial figures and further information, please refer to the official 8-K filing by Helen Of Troy Ltd.

Explore the complete 8-K earnings release (here) from Helen Of Troy Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance