Helen of Troy: Robust Capital Gains at a Fair Price

- By Robert Abbott

The consumer packaged goods industry isn't the first place most would look for companies with competitive advantages that deliver pricing power and excellent profitability.

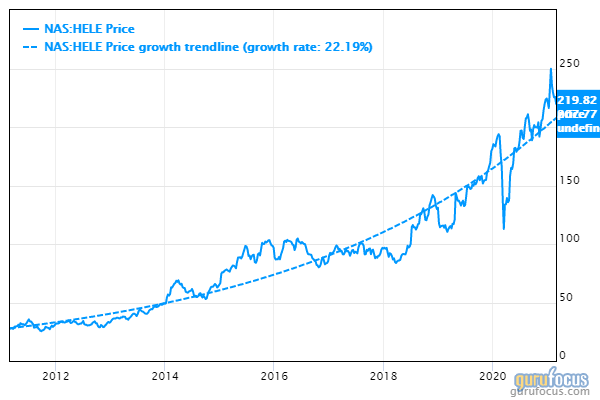

Yet, Helen of Troy Limited (NASDAQ:HELE) happens to be one such company, and investors are bidding up its share price:

What is Helen of Troy?

Based in El Paso, Texas and registered in the Bahamas, Helen of Troy is a $5.44 billion company that sells what it calls "creative products and solutions". Its 10-K for fiscal 2020, which ended Feb. 28, 2021, claimed the company has built a diversified portfolio of brands with leading market positions through new product innovation, product quality and competitive pricing.

The company reports through three segments:

Housewares includes products for cooking, cleaning, organization and other tasks. Its customers are retailers and individuals who shop its direct-to-consumer channel.

Health and Home: Most revenue comes from retailers, but it also garners some direct-to-consumer sales of health care devices, water filtration systems and small home appliances.

Beauty: Takes in beauty and personal care products, including hairstyling appliances, grooming tools and decorative hair care accessories. It sells to retailers, beauty supply wholesalers and to individuals through the direct-to-consumer channel.

Growth

In fiscal 2015, Helen of Troy launched a transformational strategy to improve the performance of its business segments and its shared service capabilities. During that period, Phase I improved organic sales, made strategic acquisitions, became a more efficient operating company, upgraded its organization and culture, improved inventory turns and returned capital to shareholders.

In Phase II, which began in fiscal 2020, its goals are to improve organic sales growth, expand its margins and strategically and effectively deploy its capital. That will involve more investments in its Leadership Brands (those that enjoy the highest or second-highest market share), international expansion and acquiring new brands.

Its most recent acquisition was of Drybar Products LLC, a hair care and styling brand, for approximately $255.9 million in cash.

Risks

At the time the 10-K was published on April 29, the company was concerned about the ongoing effects of Covid-19 on its business. It wrote, "We expect the current public health crisis resulting from the outbreak of novel coronavirus disease (commonly referred to as "COVID-19") to continue to adversely impact certain parts of our business, which could have a material impact on our operating results and financial condition."

With the increasing consolidation of retail trade, Helen of Troy depends more and more on key customers; in addition, consolidation means customers have growing bargaining power. In addition, the loss of any one of these key customers could have a material effect on its results.

"We transact a portion of our international business in currencies other than the U.S. Dollar ("foreign currencies")." Of most concern is the relationship with the Chinese Renminbi, because it buys a substantial amount of its products from Chinese manufacturers in U.S. dollars. Thus, weakening of the U.S. dollar could be a powerful headwind.

Competitors

Because it is in a mature market with few barriers to entry, Helen of Troy operates in highly competitive markets. It lists its competitors by segments:

Housewares: Lifetime Brands, Inc. (NASDAQ:LCUT), Newell Brands Inc (NASDAQ:NWL) and Yeti Holdings Inc (NYSE:YETI)

Health & Home: Exergen Corporation, Omron Healthcare, Inc. and Clorox Co. (NYSE:CLX).

Beauty: Conair Corporation (CNGA), Spectrum Brands Holdings Inc. (NYSE:SPB) and Proctor & Gamble (NYSE:PG)

The company believes it has competitive advantages, including its ownership of well-known brands, expertise in engineering and innovation, sourcing and supply chain knowledge and productive co-development relationships with manufacturers in the Far East.

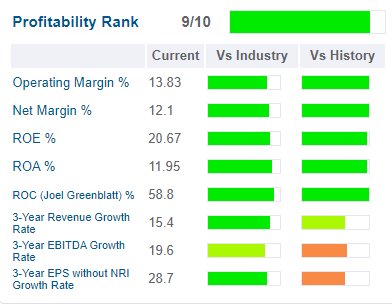

Given that it currently has a return on capital of 16.45%, that seems a credible claim. In addition, Helen of Troy is listed on the Buffett-Munger Screener, and one of the criteria for that list is, "Companies that have competitive advantages. It can maintain or even expand its profit margin while growing its business."

Financial strength

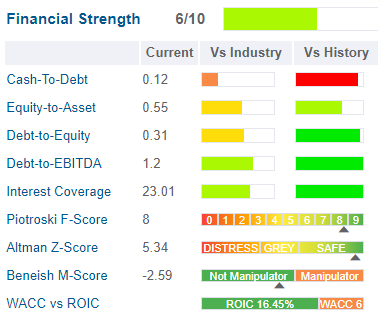

Another criterion of a Buffett-Munger company is that it incurs little debt while growing the business.

From the table above, we see Helen of Troy generally meets that standard. At the end of fiscal 2020, it had $45.12 million in cash, $1.884 million in short-term debt and capital lease obligations and $380.098 million in long-term debt. That equals a cash-to-debt ratio of 0.12.

The interest coverage ratio is also reasonable at 23.01, meaning the company has $23.01 in operating income for every dollar of interest expenses.

Its strength is underlined by the Piotroski F-Score and Altman Z-Score; both are near the top of their ranges.

Finally, we see the capital raised with debt has been well allocated; its return on invested capital (ROIC) is more than double its weighted average cost of capital (WACC).

Profitability

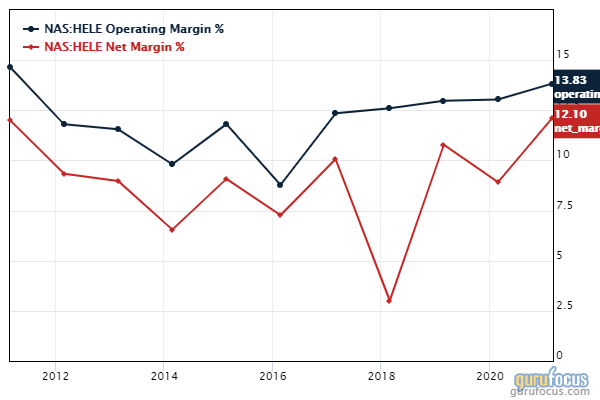

There's a lot of dark green on the profitabilty table, indicating Helen of Troy is highly profitable and that it deserves a 9-out-of-10 rating. Over the past ten years, the margins have been bumpy, but both are currently in the double digits:

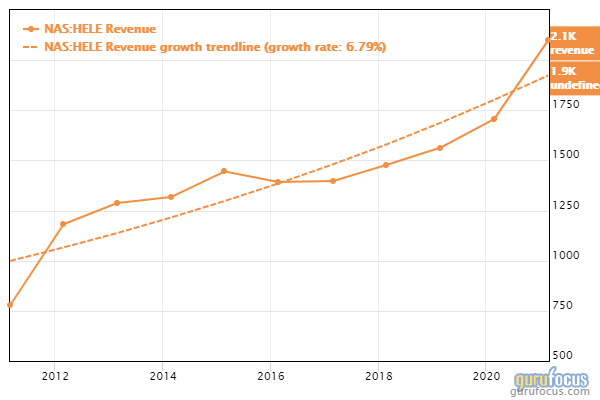

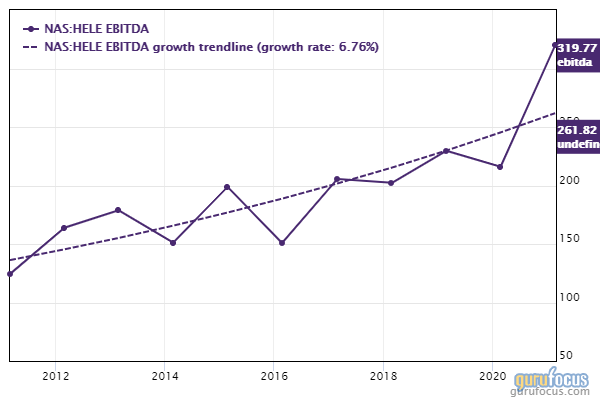

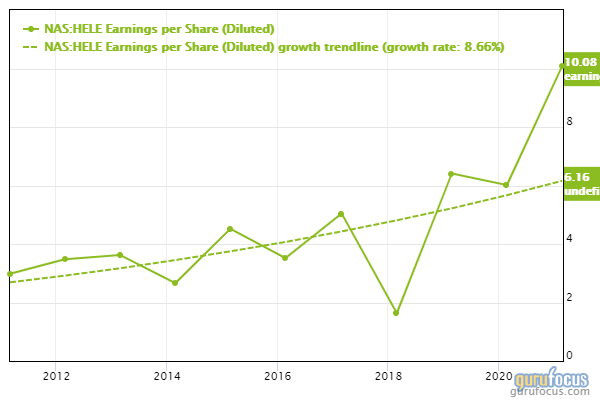

The same holds for the growth lines. With the Ebitda growth rate exceeding the revenue growth rate and the earnings per share outpacing Ebitda, we can assume the company is becoming increasingly effective and efficient.

From the trendline on the chart below, we see revenue has grown over the past 10 years, as well as the past three years shown on the table:

Ebitda has fluctuated as it has grown over the past decade, but on average we see it has kept growing:

Earnings per share (diluted) has grown particularly quickly in two of the past three years:

The first criterion of the Buffett-Munger screener is that the company must have a high predictability rating, which means consistently growing both revenue and earnings. The evidence we see on the charts suggests Helen of Troy easily makes it over this hurdle.

Performance

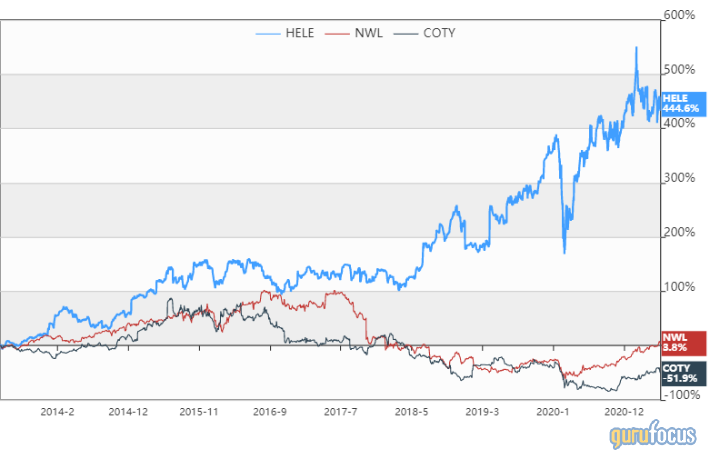

The following GuruFocus chart shows that Helen of Troy's stock price has outperformed competitors Newell and Coty Inc (NYSE:COTY):

Its annualized returns were:

One year: 33.03%

Three years: 32.92%

Five years: 17.05%

10 years: 20.60%.

Total returns over the past five years (capital gains only) were:

2021 year-to-date: -3.08%

2020 full-year: 23.58%

2019 full-year: 37.06%

2018 full-year: 36.15%

2017 full-year: 14.09%.

Dividends and share buybacks

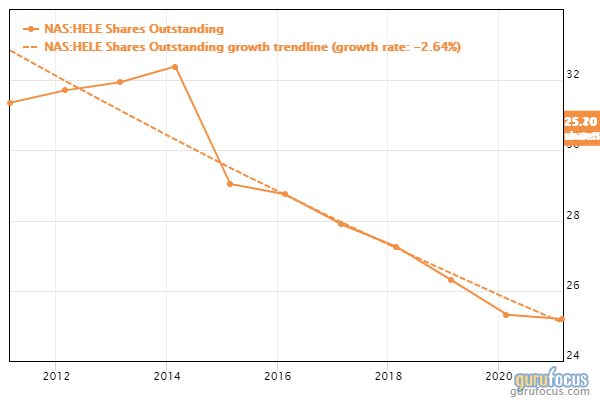

Helen of Troy does not pay a dividend, but it has been buying back its own shares:

Valuation

In terms of valuation, let's take a look at the PEG ratio, which is calculated by dividing the price-earnings ratio by the five-year Ebitda growth rate, and as a result, puts earnings results into context. Helen of Troy has a PEG ratio of 1.42, which is modestly above the fair-value mark of 1.00.

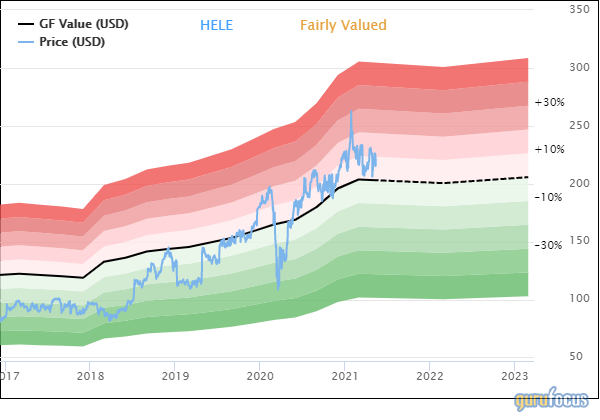

The GuruFocsu Value chart also finds the stock to be fairly valued:

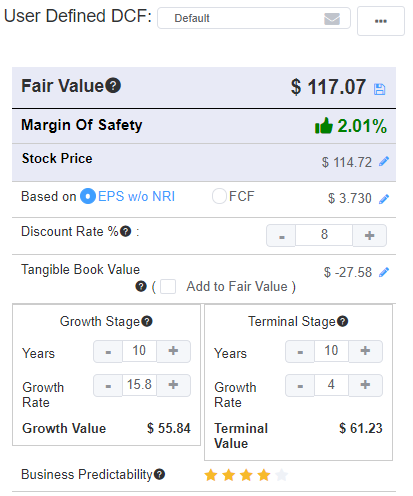

Because it has a 4 out of 5 star business predictabilty rating, we can also look at the discounted cash flow (DCF) calculator. Using an earnings-based approach with the following assumptions indicates fair valuation:

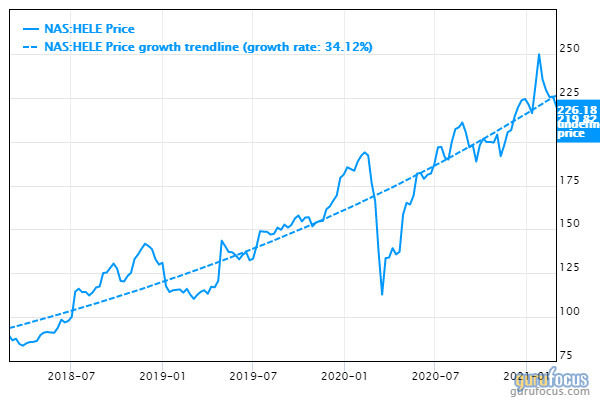

Is it worth waiting for a dip in hopes of getting a margin of safety? This three-year price chart suggests that it is a good possibility:

Gurus

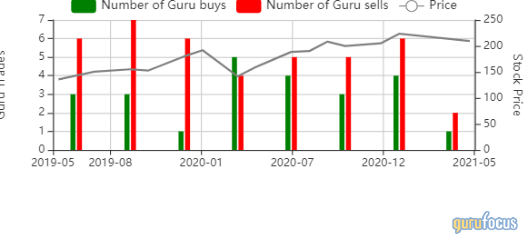

The investing gurus have been doing more selling than buying over the past two years:

In all, ten gurus have positions in Helen of Troy, and these are the three largest holdings:

Ken Fisher (Trades, Portfolio) of Fisher Asset Management held 480,378 shares at the close of trading on March 31, a reduction of 4.11%; his stake now represents 1.97% of the company's shares and 0.07% of Fisher's assets under management.

Jim Simons (Trades, Portfolio) of Renaissance Technologies owned 30,310 shares at the end of December, after a reduction of 61.97%.

Ray Dalio (Trades, Portfolio) of Bridgewater Associates added 121.72% during the fourth quarter and finished up with 28,968 shares.

Conclusion

The Buffett-Munger screener finds equities with qualities that Warren Buffett (Trades, Portfolio) characterized as being wonderful stocks at fair prices. Helen of Troy Limited appears to be such a stock.

Although it has some debt, it is able to meet its interest payment obligations and therefore should be considered financially strong. It is highly profitable, with double-digit margins as well as strong growth trends for revenue, Ebitda and earnings per share. It is also fairly valued according to the criterion for Buffett-Munger and other metrics.

Value investors may want a bigger margin of safety in my opinion, and could wait for a price dip. Growth investors who believe current trends will continue may want to consider this name.

Disclaimer: I do not own shares in any of the companies named in this article and do not expect to buy any in the next 72 hours.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance