Henry Schein (HSIC) Global Presence Aids, Macroeconomic Woes Stay

Henry Schein HSIC is well-positioned to gain from its extensive global foothold and diverse channel mix. However, unfavorable currency movement and global economic uncertainties continue to affect the business. The stock carries a Zacks Rank #3 (Hold) currently.

Henry Schein’s business boasts a broad global footprint with 61 distribution centers. Apart from North America, the company has a presence in Australia and New Zealand as well as in emerging nations like China, Brazil, Israel, the Czech Republic and Poland. An aging global population and a growing awareness of the benefits of preventative care and oral hygiene fuel the dental distribution business. We believe Henry Schein’s worldwide reach gives it a major competitive advantage over other players in the healthcare distribution industry.

In terms of the latest developments in the global markets, in the fourth quarter, Henry Schein’s Global Technology and Value-Added service sales local currency internal (LCI) increased 7.1% from the prior-year quarter’s levels. LCI sales grew 6.8% in North America and 9.8% internationally.

Henry Schein’s strategy to expand digital dentistry globally is encouraging. The company is busy promoting digital workflows for general dentistry and dental specialties. It is currently focusing on diversification of its portfolio and value-added services, and a favorable end market.

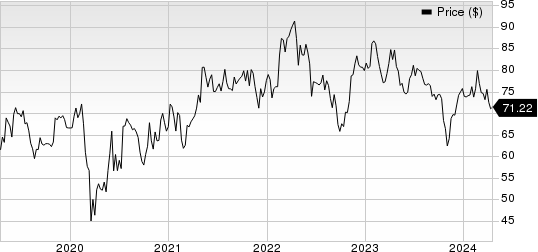

Henry Schein, Inc. Price

Henry Schein, Inc. price | Henry Schein, Inc. Quote

According to a report by Grand View Research, the global dental service market was valued at $433.2 billion in 2022 and is projected to witness a CAGR of 4.5% through 2030.

Henry Schein is witnessing growing demand for its implant systems and endodontic products, and integrated software and services solutions, which are generating strong growth by delivering greater efficiency and a better experience to its customers.

On the flip side, in October 2023, a portion of Henry Schein’s manufacturing and distribution businesses experienced a cybersecurity incident. Henry Schein took precautionary action, including taking certain systems offline and other steps to contain the incident, which led to the temporary disruption of some of its business operations. Consequently, during the fourth quarter, sales growth was adversely impacted.

Further, the current macroeconomic environment across the globe is affecting Henry Schein’s financial operations. Particularly, exchange rate fluctuations, inflation and recession are adversely impacting the company’s operational results. With the sustained macroeconomic pressure, the company may struggle to keep in check its cost of revenues and operating expenses. During the fourth quarter, Henry Schein’s SG&A expenses rose 6% year over year.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita DVA, Stryker Corporation SYK, and Cardinal Health CAH. While DaVita sports a Zacks Rank #1 (Strong Buy), Stryker and Cardinal Health carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s stock has surged 55.7% in the past year. Earnings estimates for DaVita have risen from $8.97 to $9.23 in 2024 and from $9.77 to $10.01 in 2025 in the past 30 days.

DVA’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 35.6%. In the last reported quarter, it posted an earnings surprise of 22.2%.

Stryker reported fourth-quarter 2023 adjusted EPS of $3.46, beating the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion outpaced the consensus estimate by 3.8%.

Stryker has an estimated earnings growth rate of 11.5% for 2025 compared with the S&P 500’s 9.9%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 5.1%.

Estimates for Cardinal Health’s 2024 earnings per share have remained constant at $7.28 in the past 30 days. Shares of the company have surged 31.8% in the past year compared with the industry’s 9.7% rise.

CAH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%. In the last reported quarter, it delivered an average earnings surprise of 16.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance