Henry Schein (HSIC) Q4 Earnings in Line, 2018 View Upbeat

Henry Schein, Inc. HSIC reported adjusted earnings per share (EPS) of 97 cents in the fourth quarter of 2017, up 3.2% year over year. Adjusted EPS remained in line with the Zacks Consensus Estimate. The year-over-year upside in earnings was driven by strong revenue growth across all the business segments.

Adjusted EPS for the year 2017 was $3.60, an 8.8% improvement from the year-ago period. This also remains in line with the Zacks Consensus Estimate.

Revenues in Detail

Henry Schein reported net sales of $3.32 billion in the fourth quarter, up 6.4% year over year and marginally above the Zacks Consensus Estimate of $3.30 billion. The year-over-year improvement came on the back of 5.1% internal sales growth in local currencies and 2.4% increase owing to foreign currency exchange. Acquisition growth was 4% in the quarter.

Net sales for the full year were $12.46 billion, a 7.7% improvement from the year-ago number. The top line also exceeded the Zacks Consensus Estimate of $12.44 billion.

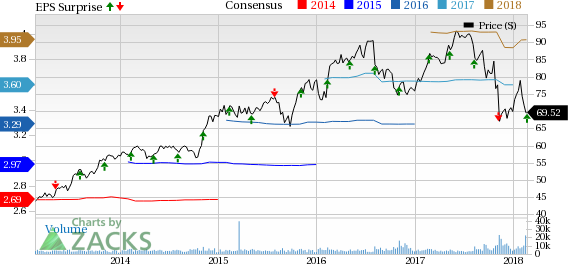

Henry Schein, Inc. Price, Consensus and EPS Surprise

Henry Schein, Inc. Price, Consensus and EPS Surprise | Henry Schein, Inc. Quote

In the fourth quarter, the company recorded sales of $2.19 billion in the North American market, up 3.1% year over year. Sales totaled $1.13 billion in the international market, up 13.1% year over year.

Segment Analysis

Henry Schein derives revenues from four operating segments: Dental, Medical, Animal Health, and Technology and Value-added services.

In the fourth quarter, the company derived $6.05 billion in revenues from global Dental sales, up 8.9% year over year. This includes 7.9% growth in local currencies and 1% contribution from foreign currency exchange. At local currencies, internally generated sales increased 3% and acquisition growth was 6.3%.

The quarterly result also had a negative impact of 5.1% from an additional week in the year-ago period. Internal growth at local currencies included 6.7% growth in North America and 0.1% rise internationally.

The company's global Animal Health segment witnessed 6.2% rise in revenues to $889.8 million. This includes 3% growth in local currencies and 3.2% increase from foreign currency exchange. At local currencies, internally generated sales increased 4.5% and acquisition growth was 3.7%. One extra week in 2016 had a 5.2% negative impact on the quarterly sales performance. The internal growth in local currencies included 6% rise in North America and 2.9% improvement internationally.

Worldwide Medical revenues rose 2.6% year over year to $636.9 million. Growth in local currencies was 2.3%, with a 0.3% increase owing to favorable foreign exchange.

Revenues from global Technology and Value-added Services grew 2.1% to $114.6 million. This included 1% growth in local currencies and a 1.1% rise related to foreign currency exchange. Acquisitions contributed 0.6% in the quarter under review.

Margin Trend

Gross profit increased 4.8% to $900.9 million in the reported quarter. However, gross margin contracted 39 basis points (bps) from the year-ago quarter to 27.2% due to a 6.9% rise in cost of sales, higher than the revenue growth rate.

Despite a 4.8% rise in selling, general & administrative expenses of $659.8 million, adjusted operating income improved 4.8% year over year to $241.2 million. However, adjusted operating margin declined 10 bps year over year to 7.3% in the reported quarter.

Financial Position

Henry Schein exited the year 2017 with cash and cash equivalents of $174.7 million, compared with $62.4 million at the end of 2016. Full-year net cash provided by operating activities was $238 million, compared with $264.5 million in the year-ago period.

During the quarter under review, the company bought back approximately 3.2 million shares for almost $225 million. At the close of the fourth quarter, the company had $200 million authorized for repurchase of common stock.

2018 Guidance

Henry Schein raised its 2018 EPS guidance to reflect the impact of U.S. tax reform legislation, including the estimated 2 cents impact associated with certain one-time cash bonus. The company currently expects EPS in the range of $4.03-$4.14, reflecting 57–61% growth from the 2017 reported EPS figure of $2.57. The previous 2018 EPS guidance range was $3.85-$3.96. The Zacks Consensus Estimate for 2018 adjusted EPS is $3.95, below the guided range.

Our Take

Henry Schein exited the fourth quarter of 2017 on a mixed note. All four of the company's operating segments recorded strong year-over-year growth. Henry Schein's strong share gains in the North American and overseas markets along with solid revenues raise optimism.

Despite the better-than-expected revenue performance, we are disappointed with the year-over-year deterioration in Henry Schein's gross and operating margin due to higher cost of sales and expenses. Increased EPS guidance for 2018 buoys optimism.

Zacks Rank & Key Picks

Henry Schein has a Zacks Rank #3 (Hold).

Some of the better-ranked stocks in the broader medical sector are PerkinElmer PKI, Bio-Rad Laboratories BIO and Becton, Dickinson and Company BDX.

Bio-Rad Laboratories has a Zacks Rank #2. You can see the complete list of today's Zacks #1 Rank stocks here. The company has a long-term expected earnings growth rate of 25%.

PerkinElmer has a long-term expected earnings growth rate of 12.3%. The stock carries a Zacks Rank #2.

Becton, Dickinson and Company has a Zacks Rank #2. The company has a long-term expected earnings growth rate of 13.3%.

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor's Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PerkinElmer, Inc. (PKI) : Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance