Hercules Capital Inc (HTGC) Q1 2024 Earnings: Aligns with Analyst EPS Projections

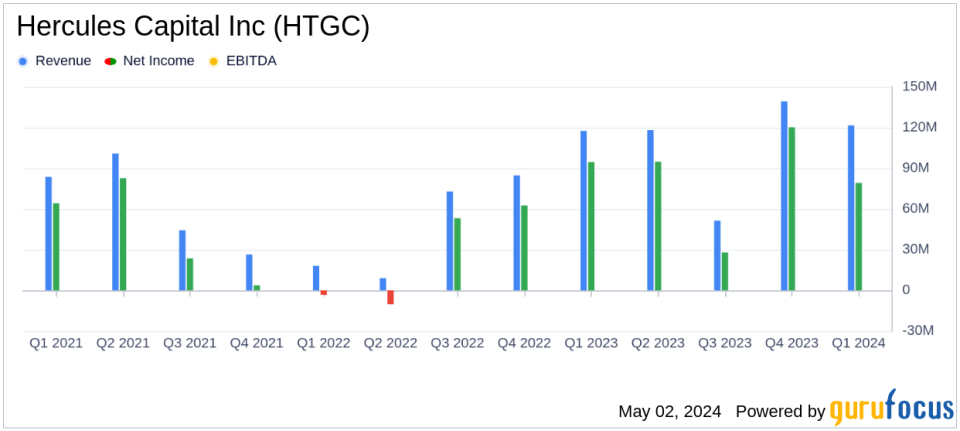

Total Investment Income: Reached $121.6 million in Q1 2024, marking a 15.7% year-over-year increase, surpassing the estimate of $119.02 million.

Net Investment Income (NII): Reported at $79.2 million or $0.50 per share, meeting the quarterly EPS estimate of $0.50 and showing a 20.9% increase from the previous year.

Total Gross Debt and Equity Commitments: Hit a record $956.0 million, an 81.7% increase year-over-year.

Total Gross Fundings: Achieved a record $605.2 million, up 27.1% from the previous year.

Assets Under Management: Grew to approximately $4.5 billion, reflecting a 14.7% increase year-over-year.

Net Asset Value (NAV) per Share: Increased by 1.7% to $11.63, driven by net realized gains from equity sales.

Liquidity: Ended the quarter with $498.1 million in available liquidity, including cash and available credit facilities.

Hercules Capital Inc (NYSE:HTGC) announced its first quarter financial results for 2024 on May 2, showcasing significant growth in total gross debt and equity commitments, which surged by 81.7% year-over-year to a record $956.0 million. The company also reported a substantial increase in total gross fundings, up 27.1% from the previous year to $605.2 million. This performance aligns with analyst expectations, with earnings per share (EPS) meeting the estimated $0.50. The full details of the earnings can be accessed through Hercules Capital's 8-K filing.

Hercules Capital, a leading specialty finance company, focuses on providing senior secured loans to high-growth, venture capital-backed companies in technology, life sciences, and sustainable and renewable technology industries. With approximately $4.5 billion of assets under management, the company has shown a robust year-over-year growth of 14.7%.

Financial Performance and Market Position

The company's total investment income for Q1 2024 reached $121.6 million, marking a 15.7% increase from the previous year. Net Investment Income (NII) was reported at $79.2 million, or $0.50 per share, providing a 125% coverage of the base cash distribution. This performance demonstrates Hercules Capital's strong market position and operational efficiency, particularly in a challenging economic environment.

CEO Scott Bluestein commented on the results, stating,

2024 is off to a tremendous start with record Q1 commitments and fundings, each growing year-over-year by 81% and 27%, respectively. Our record-setting performance in Q1 drove net debt portfolio growth by $325.3 million, our largest quarter-to-quarter increase in history."

Strategic Financial Management

Hercules Capital's balance sheet management remains conservative with a GAAP leverage of 91.0% and a net regulatory leverage of 81.7%. The company's liquidity position is strong, ending the quarter with $498.1 million in available liquidity. This financial stability is crucial as it allows Hercules to capitalize on new opportunities while maintaining robust credit discipline.

The company's debt investment portfolio saw a net increase of $325.3 million during the quarter on a cost basis, driven by new debt investment origination and funding activities. The effective yield on the debt investment portfolio was 14.9%, slightly down from 15.3% in the previous quarter, reflecting the dynamic market conditions.

Challenges and Forward Outlook

Despite the positive performance, Hercules faces challenges such as increased competition in the venture debt markets and potential market volatility. However, the company's strategic position and diversified investment approach should help mitigate these risks. Looking forward, Hercules Capital is well-positioned to leverage its scale and liquidity to enhance shareholder value and capitalize on the improving market environment.

For more detailed information and to stay updated on Hercules Capital's financial journey, visit our detailed reports and analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Hercules Capital Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance