Here is what Uber’s IPO says about the broader stock market

Uber’s IPO is reportedly expected to price Thursday and trade Friday, capping months of high-profile IPOs including rival Lyft (LYFT), along with Pinterest (PINS) and Levi Strauss (LEVI) to name a few.

The parade of IPOs typically has been a sign of a peaking stock market, but hedge fund manager Anthony Scaramucci, founder of SkyBridge Capital, thinks this time is different.

“I’m not saying [the market] isn’t going to peak, because I’m a big believer in cyclicality,” Scaramucci told Yahoo Finance at his 10th annual SALT conference in Las Vegas. “There’s a lot of pent up demand for IPOs. There was tremendous amounts of excess regulation during the Obama Administration and the relaxation of that has unleashed this capital market activity, so I don’t think it’s the sign of a top yet.”

Reports suggest Uber is heeding the signals that investors sent to the market after Lyft’s IPO.

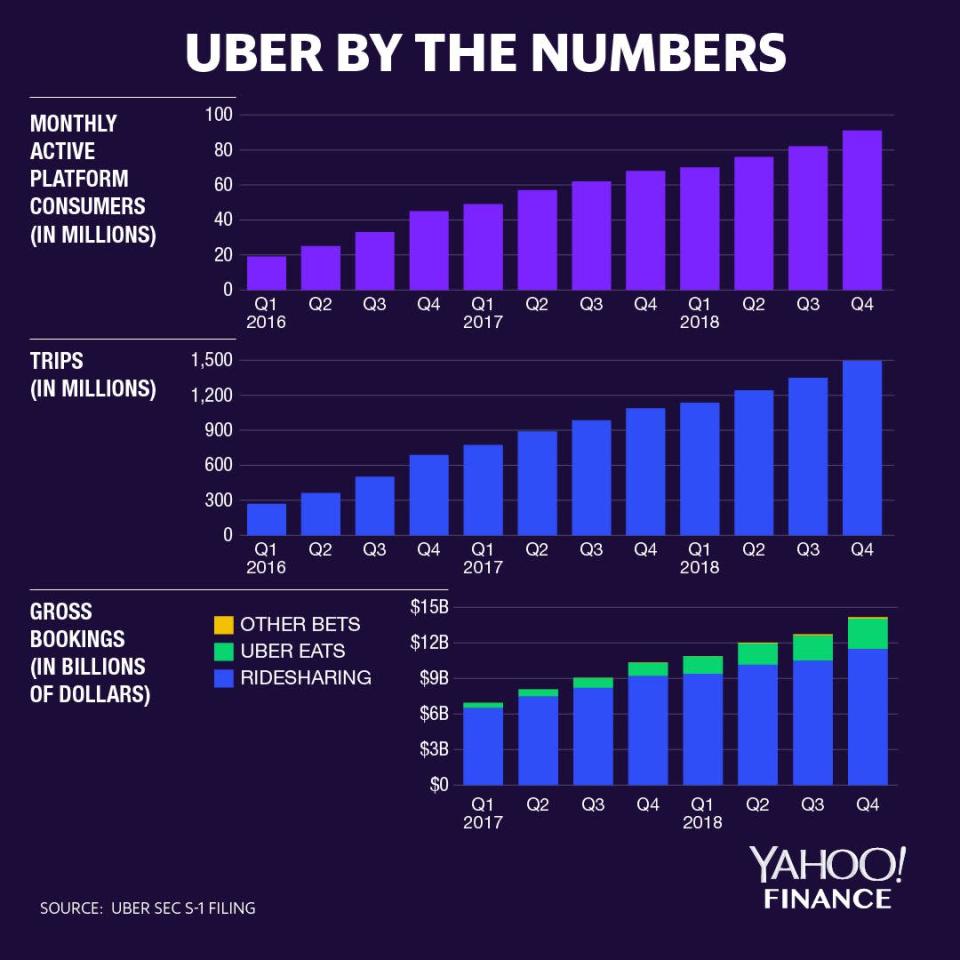

Uber is planning to price its IPO at a roughly $90 billion valuation, according to the Wall Street Journal, down from a previous estimate of well over $100 billion.

Lyft shares, which surged to $88 on its IPO day, are now trading at roughly $53 a share six weeks later. That’s a nearly 40% decline.

“Lyft, while it’s shares have gone down, still has a very high market capitalization for a new company,” said billionaire investor David Rubenstein, co-founder and co-executive chairman of The Carlyle Group (CG), which invested in UK ride sharing app Addison Lee in 2013.

Rubenstein isn’t alone in marveling at the multi-billion dollar valuations that are common in today’s IPO marketplace.

Billionaire investor Steve Case, co-founder of AOL, remembers a time decades ago when companies went public at much smaller valuations.

“I remember when AOL went public — it was the first internet company to go public in 1992,” Case told Yahoo Finance. “And we raised $10 million in our IPO and the company that day was worth $70 million. So to now hear about these $100 billion IPOs is a different world.”

—

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

More from Scott:

Billionaire Ken Fisher: Why the stock market likely has more room to run

Warren Buffett: 'Something different' is happening in the economy right now

The market is starting to overreact to very specific economic data points

2019 may be the year of tariffs against European auto imports

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance