Here's How 2022 Unfolds for DICK'S Sporting (DKS) Stock

DICK’S Sporting Goods Inc. DKS stock is well-poised to continue its momentum in 2022, driven by its strong fundamentals and growth efforts. Strong customer demand and improved product assortment have been aiding its sales and merchandise margin. Continued focus on store growth and omni-channel initiatives bode well.

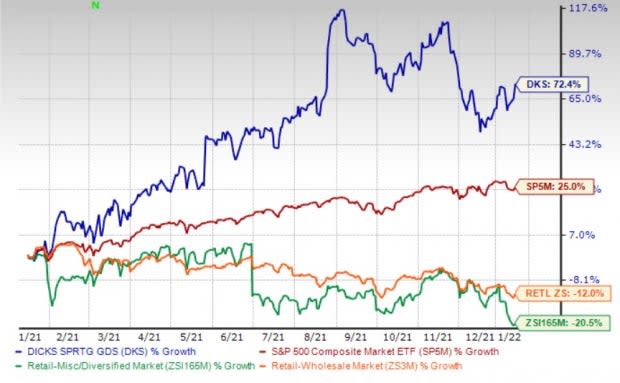

In the past year, the DKS stock has outperformed the industry, the Retail-Wholesale and the market at large. The company’s stock has surged 72.4% compared with the S&P 500’s growth of 25%. It also compared favorably with the industry and sector’s declines of 20.5% and 12%, respectively.

DICK’S Sporting’s earnings estimates for the fourth quarter and fiscal 2021 have moved up 3.5% and 2.1%, respectively, in the past seven days. The Zacks Consensus Estimate for the Zacks Rank #3 (Hold) company’s current financial year’s sales and earnings suggests growth of 27.6% and 150.7%, respectively, from the year-ago period’s reported numbers. The positive trend signifies bullish analyst sentiments.

Image Source: Zacks Investment Research

Factors to Keep the Momentum Going

DICK’S Sporting is anticipated to retain its strong performance on strong customer demand, improved product assortment and online strength. The company also remains on track with the transformational plan. It noted that the fiscal fourth quarter started on a strong note.

Management raised its fiscal 2021 view. Fiscal 2021 sales are expected to be $12,120-$12,190 million, up from the previously mentioned $11,520-$11,720 million. Same-store sales are anticipated to grow 24-25%, up from the earlier stated 18-20%. Adjusted earnings are envisioned to be $14.6-$14.8, reflecting a sharp improvement from $12.45-$12.95 per share mentioned earlier.

For fiscal 2021, the gross margin is estimated to be higher than that reported in fiscal 2020 and 2019 on the back of improved merchandise margins and lower fixed expenses. SG&A expenses are likely to decline from the figures reported in fiscal 2020 and 2019 due to higher sales. Adjusted EBT is likely to be $1.89-$1.92, up from the previously mentioned $1.61-$1.67. The adjusted EBT margin is expected to be 15.7%.

DICK’S Sporting has been gaining from continued focus on developing every possible avenue to generate greater sales. As part of its long-term strategy, the company plans to make significant investments in e-commerce, technology, store payroll, Team Sports and private brands. It also remains on track to build the best omni-channel experience for athletes by strengthening the store network and expanding the e-commerce presence. The online unit benefits from services like in-store and curbside pickup, reduced promotions, faster delivery, and a better checkout experience. Its mobile platform remains another key growth driver.

On the store-front, DICK’S Sporting earlier launched two types of concept stores, OVERTIME by DICK’S Sporting Goods and DICK’S Sporting Goods Warehouse. The move is in sync with its plans to expand outlet and clearance stores to offer popular athletic brands at discounted prices. It opened the second DICK’S House of Sport in Knoxville, TN, two newly redesigned Golf Galaxy locations, three warehouse stores and experiential in-store Soccer Shops in certain stores in June.

The company’s first two DICK’s House of Sport stores in Rochester, NY, and Knoxville, TN, have been receiving positive customer responses. The two Golf Galaxy performance centers, featuring TrackMan and BioMech golf technologies, are also performing well. The company launched two Public Lands stores in Pittsburgh and Columbus.

Near-Term Headwinds

Like others in the industry, DICK’S Sporting continues to witness higher compensation and safety expenses associated with the COVID-19 crisis. The persistence of additional costs related to the ongoing COVID-19 pandemic is likely to weigh on the company’s bottom line in the near term. It also expects elevated freight expenses and supply-chain issues to linger in the fiscal fourth quarter.

Here's How Other Stocks Fared

We have highlighted three better-ranked stocks in the Retail - Wholesale sector, namely Citi Trends CTRN, Kohl's KSS and Zumiez Inc. ZUMZ.

Citi Trends — a value-priced retailer of fashion apparel, accessories and home goods — currently sports a Zacks Rank #1. Shares of the company have gained 4.3% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Citi Trends’ sales and earnings per share (EPS) for the current financial year suggests growth of 29.6% and 186.6%, respectively, from the year-ago period. CTRN has a trailing four-quarter earnings surprise of 79.5%, on average.

Kohl's, a department store chain that operates specialty department stores and an e-commerce site in the United States, presently flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 114.5%, on average. Shares of the company have gained 5.3% in the past year.

The Zacks Consensus Estimate for Kohl's sales and EPS for the current financial year suggests growth of 24.1% and 704.1%, respectively, from the year-ago period. KSS has an expected EPS growth rate of 8% for three-five years.

Zumiez, one of the leading global lifestyle retailers, sports a Zacks Rank #1 at present. The company has a trailing four-quarter earnings surprise of 2,560%, on average. Shares of ZUMZ have lost 1% in the past year.

The Zacks Consensus Estimate for Zumeiz’s sales and EPS for the current financial year suggests 20.4% and 63.3% growth, respectively, from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zumiez Inc. (ZUMZ) : Free Stock Analysis Report

Kohl's Corporation (KSS) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Citi Trends, Inc. (CTRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance