Here's What Genus plc's (LON:GNS) Shareholder Ownership Structure Looks Like

If you want to know who really controls Genus plc (LON:GNS), then you'll have to look at the makeup of its share registry. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. We also tend to see lower insider ownership in companies that were previously publicly owned.

With a market capitalization of UK£1.6b, Genus is a decent size, so it is probably on the radar of institutional investors. In the chart below, we can see that institutions are noticeable on the share registry. We can zoom in on the different ownership groups, to learn more about Genus.

See our latest analysis for Genus

What Does The Institutional Ownership Tell Us About Genus?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

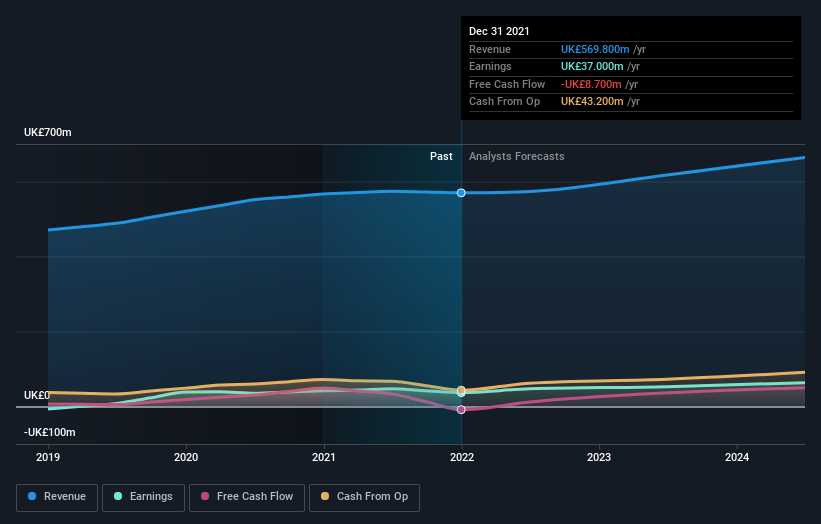

We can see that Genus does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Genus' earnings history below. Of course, the future is what really matters.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. We note that hedge funds don't have a meaningful investment in Genus. Capital Research and Management Company is currently the company's largest shareholder with 9.6% of shares outstanding. In comparison, the second and third largest shareholders hold about 9.0% and 5.2% of the stock.

On further inspection, we found that more than half the company's shares are owned by the top 10 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Genus

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data suggests that insiders own under 1% of Genus plc in their own names. It's a big company, so even a small proportional interest can create alignment between the board and shareholders. In this case insiders own UK£4.7m worth of shares. Arguably, recent buying and selling is just as important to consider. You can click here to see if insiders have been buying or selling.

General Public Ownership

With a 13% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Genus. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Genus is showing 1 warning sign in our investment analysis , you should know about...

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance