Here's What Hunter Douglas N.V.'s (AMS:HDG) P/E Ratio Is Telling Us

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll look at Hunter Douglas N.V.'s (AMS:HDG) P/E ratio and reflect on what it tells us about the company's share price. Based on the last twelve months, Hunter Douglas's P/E ratio is 8.53. That corresponds to an earnings yield of approximately 11.7%.

View our latest analysis for Hunter Douglas

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share (in the reporting currency) ÷ Earnings per Share (EPS)

Or for Hunter Douglas:

P/E of 8.53 = €66.36 (Note: this is the share price in the reporting currency, namely, USD ) ÷ €7.78 (Based on the trailing twelve months to September 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each €1 of company earnings. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does Hunter Douglas Have A Relatively High Or Low P/E For Its Industry?

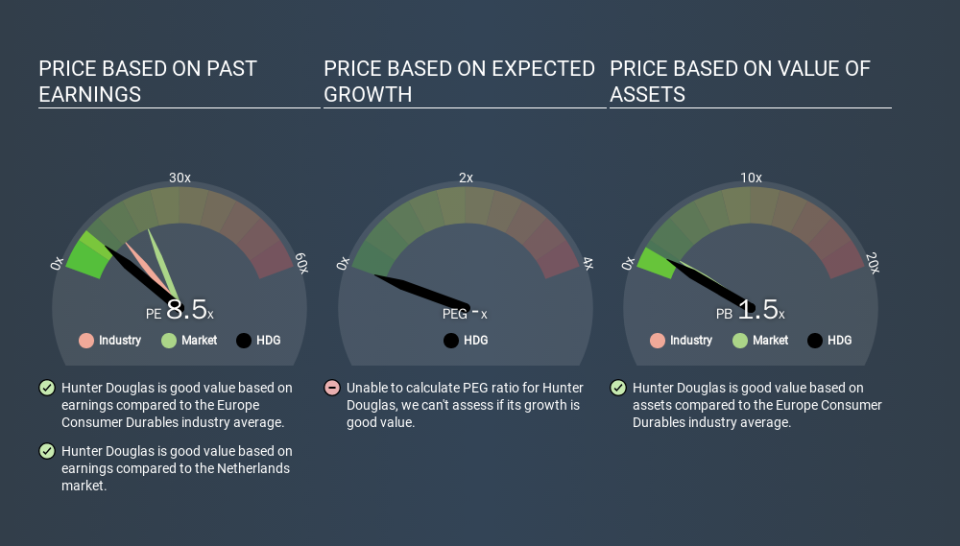

We can get an indication of market expectations by looking at the P/E ratio. We can see in the image below that the average P/E (13.1) for companies in the consumer durables industry is higher than Hunter Douglas's P/E.

Its relatively low P/E ratio indicates that Hunter Douglas shareholders think it will struggle to do as well as other companies in its industry classification. Many investors like to buy stocks when the market is pessimistic about their prospects. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Hunter Douglas increased earnings per share by 5.9% last year. And earnings per share have improved by 18% annually, over the last five years.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

So What Does Hunter Douglas's Balance Sheet Tell Us?

Hunter Douglas has net debt equal to 25% of its market cap. While that's enough to warrant consideration, it doesn't really concern us.

The Bottom Line On Hunter Douglas's P/E Ratio

Hunter Douglas's P/E is 8.5 which is below average (20.7) in the NL market. EPS grew over the last twelve months, and debt levels are quite reasonable. If growth is sustainable over the long term, then the current P/E ratio may be a sign of good value.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

You might be able to find a better buy than Hunter Douglas. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance