Here's how so many young people in China own their houses debt-free

REUTERS/China Daily

House ownership might be a distant dream for the younger generation in the UK, but the same cannot be said for their counterparts in China.

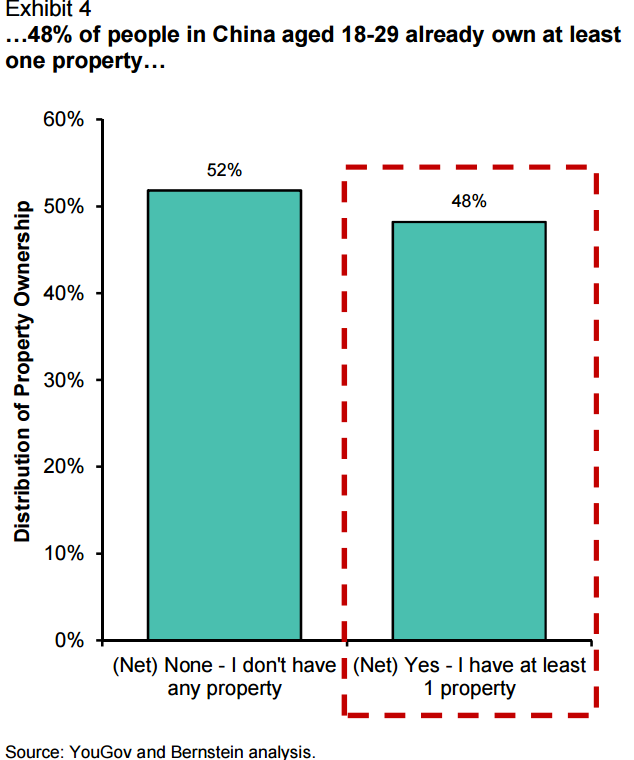

About half of 18- to 29-year-olds in China own at least one house, according to research by Bernstein.

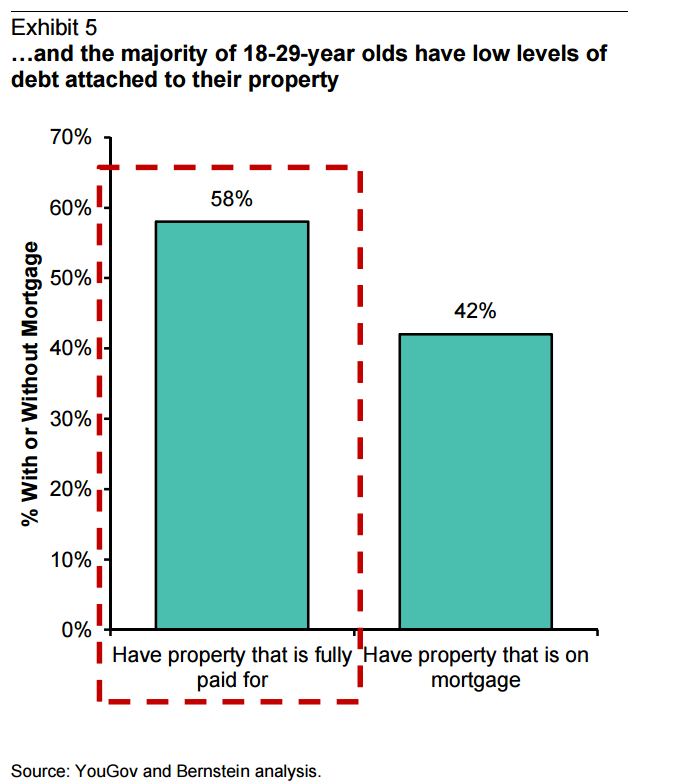

About half of those do so debt-free, which Bernstein suggests is made possible thanks to the "Bank of Mum and Dad" as a key path to home ownership for the younger generation.

The survey wasn't huge, containing only about 700 individuals, but it was enough to make some conclusions.

Here's Bernstein (emphasis ours):

"Every survey has wildcards. There are bound to be some Internet millionaires in our group of ~700 individuals between the ages of 18 and 29. However, the primary channel through which someone living in a Tier 1, Tier 2, or Tier 3 city in China owns a property without any debt attached by the age of 29 is through the Bank of Mum and Dad."

"In short, for a large portion of the group that we surveyed, we do not believe that the question of intergenerational wealth transfer is theoretical or prospective. Instead, it is already occurring."

Here's the chart of home ownership:

REUTERS/China Daily

And here's how they're funding it:

REUTERS/China Daily

This is good news, Bernstein says, because it means a potential debt bubble won't be popped by the reduction in affordability of homes:

"At the margin, this makes us more positive about the Chinese property market. One of the most commonly cited potential sources of an asset bubble in China today is the property market and, in particular, the property market in Tier 1 cities."

"The affordability index (the ratio of average property price to average annual income) has increased over the last year by roughly two-thirds, while affordability — as measured by this metric — has improved in Tier 2 and Tier 3 cities. Our survey takers aged 18-29 were actually more likely to own property if they live in a Tier 1 city."

NOW WATCH: 7 amazing maps that show how important Canada is

See Also:

Yahoo Finance

Yahoo Finance