Here's How Sally Beauty (SBH) Looks Ahead of Q1 Earnings

Sally Beauty Holdings, Inc. SBH is scheduled to release first-quarter fiscal 2020 results on Feb 6. This international specialty retailer and distributor of professional beauty supplies has trailing four-quarter positive earnings surprise of 4.2%, on average. Let’s see how the company is positioned ahead of the upcoming quarterly results.

Estimates Picture

The Zacks Consensus Estimate for fiscal first-quarter earnings is currently pegged at 56 cents per share, which suggests a decline of 1.8% from the year-ago quarter’s figure. Notably, the consensus mark has remained unchanged in the past 30 days. Also, the Zacks Consensus Estimate for revenues is pegged at $994.3 million, which suggests slight improvement of 0.5% from the year-ago quarter’s level.

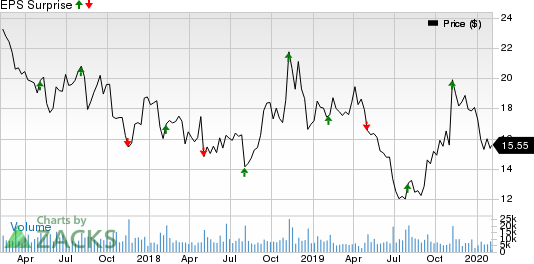

Sally Beauty Holdings, Inc. Price and EPS Surprise

Sally Beauty Holdings, Inc. price-eps-surprise | Sally Beauty Holdings, Inc. Quote

Key Factors to Note

Sally Beauty has been benefiting from focus on its Transformation Plan. In this regard, the company has been improving customers’ experience, strengthening e-commerce capacities, curtailing costs and enhancing retail fundamentals. Notably, Sally Beauty rolled out Oracle-based point-of-sale (POS) systems in the United States and Canada. Additionally, the company is undertaking efforts to upgrade its websites along with e-commerce and mobile capabilities for all the segments. Further, Sally Beauty’s supply-chain initiatives like optimizing inventory levels and minimizing costs bode well.

However, sales in the company’s Sally Beauty Supply (SBS) segment have been declining for quite some time. SBS has been struggling with challenges in Europe and foreign-currency headwinds. Apart from this, the company expects higher SG&A expenses for fiscal 2020 owing to increase in wages in key markets along with higher investment in marketing and technology. The impact of these expenses is likely to have impacted the company’s fiscal first-quarter performance. In the last earnings call, management stated that revenues and profits are likely to be bent towards the second half of fiscal 2020.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Sally Beauty this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Sally Beauty carries a Zacks Rank #3 and has an Earnings ESP of +1.11%.

Other Stocks With Favorable Combinations

Here are other companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Denny's Corporation DENN presently has an Earnings ESP of +5% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Gap, Inc. GPS currently has an Earnings ESP of +5.43% and a Zacks Rank #2.

Macy's, Inc. M has an Earnings ESP of +1.55% and a Zacks Rank #2.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.7% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Denny's Corporation (DENN) : Free Stock Analysis Report

Sally Beauty Holdings, Inc. (SBH) : Free Stock Analysis Report

Macy's, Inc. (M) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance