Shareholders Of Trade Desk (NASDAQ:TTD) Have Received 12-Times Their Investment In The Last Three Years

While The Trade Desk, Inc. ( NASDAQ:TTD ) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 24% in the last quarter. But that doesn't displace its brilliant performance over three years. Over that time, we've been excited to watch the share price climb an impressive 1,242%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The only way to form a view of whether the current price is justified is to consider the merits of the business itself.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Trade Desk

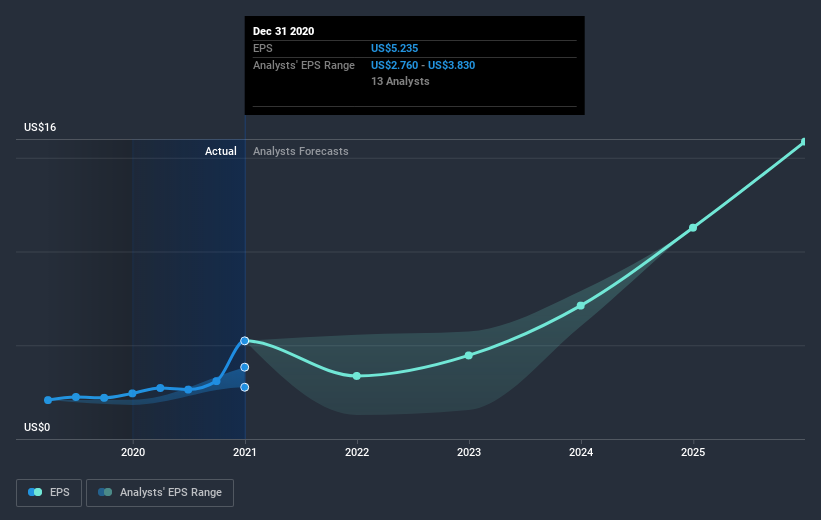

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Trade Desk achieved compound earnings per share growth of 61% per year. In comparison, the 138% per year gain in the share price outpaces the EPS growth.So it's fair to assume the market has a higher opinion of the business than it did three years ago.It is quite common to see investors become enamoured with a business, after a few years of solid progress. This optimism is also reflected in the fairly generous P/E ratio of 141.52.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Trade Desk has grown profits over the years, but the future is more important for shareholders. This free interactive report on Trade Desk's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Trade Desk shareholders have gained 319% (in total) over the last year. That's better than the annualized TSR of 138% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 3 warning signs we've spotted with Trade Desk.

Of course Trade Desk may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance