Here's Why You Should Add Union Pacific (UNP) to Your Portfolio

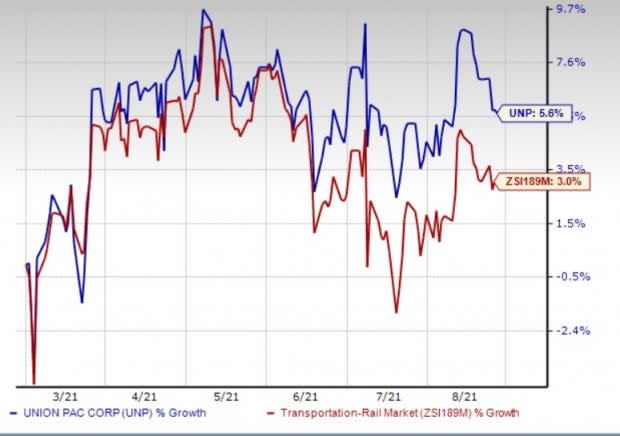

Shares of Union Pacific Corporation UNP have gained 5.6% so far this year compared with the 3% appreciation of its industry.

Image Source: Zacks Investment Research

Let’s look into the factors that are working in favor of this currently Zacks Rank #2 (Buy) stock. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Northward Earnings Estimates: The Zacks Consensus Estimate for current-quarter earnings has been revised 3.6% upward over the past 60 days. For 2021, the consensus mark for earnings has moved 4.5% north in the same time frame. The favorable estimate revisions reflect the confidence of brokers in the stock.

Given the wealth of information at brokers’ disposal, it is in the best interest of investors to be guided by their expert advice and the direction of their estimate revisions. This is because the path of estimate revisions serves as an important pointer when it comes to ascertaining the stock price.

Impressive Revenue Growth: The Zacks Consensus Estimate for current-quarter revenues is pegged at $5.53 billion, indicating a 12.5% rise from the year-ago quarter’s reported figure. Similarly, the consensus mark for current-year revenues stands at $21.64 billion, implying a 10.8% increase from the prior-year reported figure.

Other Tailwinds: Union Pacific is being aided by the betterment of the freight scenario in the United States. Evidently, freight revenues, which accounted for bulk of the top line, rose 29% in the June quarter. With economic activities gaining pace, overall volumes are improving. In second-quarter 2021, overall volumes rose 22% year over year.

We are also impressed with the company's efforts to reward its shareholders even in these challenging times. In first-half 2021, the company returned $5.4 billion to its shareholders through dividends ($1.3 billion) and buybacks ($4.1 billion). In May, it hiked its quarterly dividend by 10% to $1.07 per share. It expects a dividend payout of approximately 45% (of earnings) in 2021. Union Pacific anticipates repurchasing shares worth roughly $7 billion in 2021. Strong free cash flow generation by the railroad operator (up 8.6% to $1,798 million in first-half 2021) is supporting shareholder-friendly activities.

Other Stocks to Consider

Investors interested in the broader Zacks Transportation sector can also consider stocks like Knight-Swift Transportation Holdings KNX,Landstar System, Inc. LSTR and Herc Holdings Inc. HRI.While Knight-Swift and Landstar carry a Zacks Rank of 2 at present, Herc Holdings sports a Zacks Rank #1 (Strong Buy), currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings per share (three to five years) growth rate for Knight-Swift, Landstar and Herc Holdings is pegged at 12.8%, 12% and 49.2%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

KnightSwift Transportation Holdings Inc. (KNX) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Herc Holdings Inc. (HRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance