Here's Why You Should Add Veeva (VEEV) to Your Portfolio Now

Veeva Systems Inc. VEEV is likely to gain from a slew of positive developments in recent times and a raised view for fiscal 2020.

Shares of this company have rallied 39.6% compared with the industry’s 16.6% rise in a year’s time. The current level also compares favorably with the S&P 500 index’s 23.8% rise over the same time frame.

This $22-billion pharmacy innovation company currently has a Zacks Rank #2 (Buy). Veeva’s earnings are expected to grow 21.9% in the next five years. Also, the company has a trailing four-quarter positive earnings surprise of 11.7%, on average.

The stock also has a Growth Score of B. Our research shows that stocks with a Momentum Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, are better picks than most.

Let’s take a closer look at the factors that are working in favor of the company right now.

Developments & Raised View

A series of recent developments are expected to aid the stock.

This month, seven of the top 20 largest global pharmaceutical companies have picked the Veeva Vault Study Startup. It is an advanced application that eliminates manual processes to speed cycle times and trial execution.

Earlier, the company had introduced Veeva Vault Payments, an add-on application for Veeva Vault CTMS that manages the payment and reimbursement process on clinical research sites. (Read More: Veeva Systems Boosts Product Portfolio With New Application)

The company has also announced that Veeva SiteVault Free, a free eRegulatory solution for clinical research sites, is now available for replacing manual and paper-based regulatory processes by providing a modern cloud application. Veeva SiteVault Free supports an unlimited number of studies, documents and users, and provides customer support.

Reflective of these, the company raised its revenue guidance for fiscal 2020.

The company projects revenues within $1,088 million and $1,091 million, compared with the earlier range of $1,062-$1,065 million.

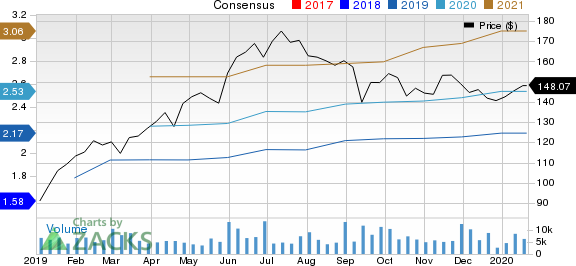

Veeva Systems Inc. Price and Consensus

Veeva Systems Inc. price-consensus-chart | Veeva Systems Inc. Quote

However, high expenses on the operational side and significant competition from the likes of Oracle and Microsoft MSFT might impact the company.

Which Way Are Estimates Headed?

For fiscal 2020, the Zacks Consensus Estimate for revenues is pegged at $1.09 billion, indicating an improvement of 26.5% from the year-ago quarter’s reported figure. For adjusted earnings, the same stands at $2.17 per share, suggesting growth of 33.1% from the year-ago reported figure.

Other Key Picks

Other top-ranked stocks in the broader medical space are Cerner Corporation CERN and DexCom DXCM, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cerner’s long-term earnings growth rate is estimated at 13.6%.

DexCom’s fourth-quarter earnings growth rate is projected at 31.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Cerner Corporation (CERN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance