Here's Why Biogen (BIIB) Stock is Up 12.6% This Year So Far

Biogen BIIB has an interesting pipeline with key assets in Alzheimer’s. Biogen is exploring both early to mid-stage assets and late-stage assets to build its pipeline.

Biogen has the opportunity to launch three potential new drugs across four indications in 2023, all in areas of high unmet need, including Alzheimer's disease, major depressive disorder, postpartum depression and SOD1-ALS.

In Alzheimer’s, the FDA granted accelerated approval to Biogen and partner Eisai’s Leqembi (lecanemab), an anti-amyloid beta protofibril antibody drug, in January to treat early Alzheimer’s disease (early AD). Leqembi’s FDA approval was a key driver of Biogen’s stock price this year.

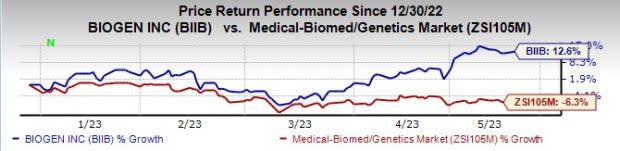

Biogen’s stock has risen 12.6% this year so far against a decrease of 6.3% for the industry.

Image Source: Zacks Investment Research

Eisai submitted a supplemental biologics license application (sBLA) to the FDA for the traditional approval of Leqembi the same day it received the accelerated approval.

The sBLA was based on data from the large phase III confirmatory study, Clarity AD, on lecanemab, which showed that treatment with lecanemab in the early stages of the disease reduced the rate of clinical decline on the CDR-SB scale by 27% compared to placebo. The FDA will study the Clarity AD data to determine whether to convert the accelerated approval of Leqembi to a traditional approval. If Leqembi receives a traditional approval and broader CMS coverage in the United States, the drug has the potential to generate blockbuster sales.

Eisai’s marketing authorization applications for lecanemab are also under review in Japan, China and EU.

In April, the FDA approved Biogen’s tofersen 100 mg/15mL injection under the brand name Qalsody for the treatment of amyotrophic lateral sclerosis (ALS) in adults who have a mutation in the superoxide dismutase 1 (SOD1) gene.

Another potential new product launch this year could be that of Biogen and partner Sage Therapeutics’ SAGE zuranolone. Biogen and Sage Therapeutics’ zuranolone, a rapid-acting, once-daily, oral treatment, is under priority review in the United States (PDUFA action date of Aug 5, 2023) for the treatment of both major depressive disorder and postpartum depression. Earlier this year, Biogen and Sage announced that the FDA has informed them that it does not currently plan to convene an advisory committee meeting to discuss the NDA for zuranolone.

The rapid progress of pipeline candidates has been the key to Biogen’s stock uptrend this year.

Biogen is facing multiple challenges at present like the generic erosion of key multiple sclerosis drug, Tecfidera, competitive pressure for spinal muscular atrophy treatment, Spinraza, declining profit share of Rituxan (from partner Roche) in the United States and the failure of controversial Alzheimer’s drug, Aduhelm. Most of its key drugs are facing declining sales. However, potential new product launches, Leqembi in Alzheimer’s disease, tofersen in ALS and zuranolone in depression can help revive growth

Zacks Rank & Stocks to Consider

Biogen currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Ocuphire Pharma OCUP and Ligand Pharmaceuticals LGND, both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss per share estimates for Ocuphire Pharma have narrowed from 29 cents to 24 cents for 2023 and from 86 cents to 81 cents for 2024 in the past 60 days. Shares of OCUP have surged 42.2% this year so far. Earnings of Ocuphire beat estimates in three of the last four quarters and missed the mark in one, the average surprise being 23.85%.

Ligand’s earnings per share estimates have risen from $4.15 to $4.16 for 2023 and from $4.28 to $4.58 for 2024 in the past 60 days. Shares of LGND have risen 16.2% this year so far. Earnings of Ligand beat estimates in two the last four quarters, while missing in the other two, the average surprise being 21.50%

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report

Ocuphire Pharma, Inc. (OCUP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance