Here's Why Buying Brown and Brown (BRO) Stock Seems Prudent

Brown and Brown’s BRO solid segmental performance, sturdy financial position and effective capital deployment along with favorable growth estimates make it a good investment choice.

This insurance broker has a solid track of beating earnings estimates in the last eight years. Its net earnings per share witnessed a five-year CAGR of 14%.

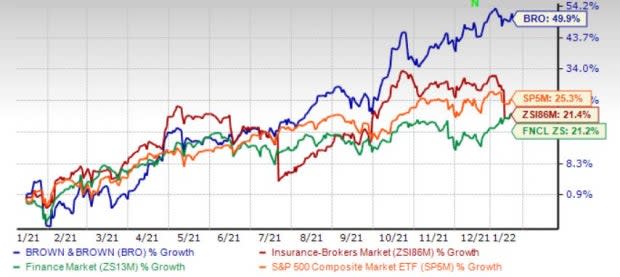

Zacks Rank & Price Performance

Brown and Brown currently carries a Zacks Rank #2 (Buy). In a year’s time, the stock has rallied 49.9%, outperforming the industry’s increase of 21.4%, the Finance sector’s rise of 21.2% and the S&P 500’s rally of 25.3%.

Image Source: Zacks Investment Research

Growth Projections

The Zacks Consensus Estimate for 2022 earnings is pegged at 2.27, up 5.1% on about 8% higher revenues of $3.3 billion.

Estimate Revision

The Zacks Consensus Estimate for 2022 earnings has moved north by a cent in the past seven days, reflecting analyst optimism.

Business Tailwinds

Increasing commissions and fees across its segments continue to drive the top line for Brown and Brown. Revenues witnessed a 10-year CAGR of 10% and exceeded the peer average and the S&P 500. Improving new business, solid retention and continued rate increases for most lines of coverage should help retain the growth momentum.

Brown & Brown has an impressive inorganic story, acquiring more than 500 insurance intermediary operations in more than two decades. Strategic acquisitions helped it strengthen its compelling products and service portfolio while expanding its global reach.

Strategic investments to drive organic growth, improve efficiency and margin bode well for BRO.

Strong Capital Position

Brown and Brown maintains a solid balance sheet with sufficient liquidity and low leverage. Banking on its stable cash flow, BRO has raised dividends for the last 28 years at a five-year CAGR of 8.7% besides engaging in share buybacks. Free cash flow witnessed a 10-year CAGR of 9%.

Brown and Brown boasts a five-year total shareholder return of 205%, much above its peer group and the S&P 500.

Other Stocks to Consider

Investors interested in the same space can look at Marsh & McLennan Companies MMC, Ryan Specialty Group RYAN and Willis Towers Watson plc WTW, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) here.

The Zacks Consensus Estimate for Marsh & McLennan’s 2022 earnings stands at $6.74, indicating an increase of 9.5% year over year. The consensus estimate has moved up by a cent in the past seven days. The expected long-term earnings growth is 12.9%, better than the industry average of 12.6%.

The Zacks Consensus Estimate for Ryan Specialty’s 2022 earnings stands at $1.22, implying an increase of 13.6% year over year. The consensus estimate has moved up by a cent in the past seven days. Ryan Specialty delivered an earnings surprise of 41.18% in the last reported quarter.

The Zacks Consensus Estimate for Willis Towers Watson’s 2022 earnings stands at $13.88, suggesting a 5.9% year-over-year increase. Willis Towers Watson delivered a four-quarter average earnings surprise of 15.27%.

Shares of Marsh & McLennan, Ryan Specialty and Willis Towers Watson have gained 46.4%, 33.6% and 12.5% in a year’s time.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Willis Towers Watson Public Limited Company (WTW) : Free Stock Analysis Report

Ryan Specialty Group Holdings, Inc. (RYAN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance