Here's Why California BanCorp (NASDAQ:CALB) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like California BanCorp (NASDAQ:CALB). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for California BanCorp

California BanCorp's Improving Profits

California BanCorp has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. California BanCorp's EPS skyrocketed from US$2.01 to US$2.85, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 42%.

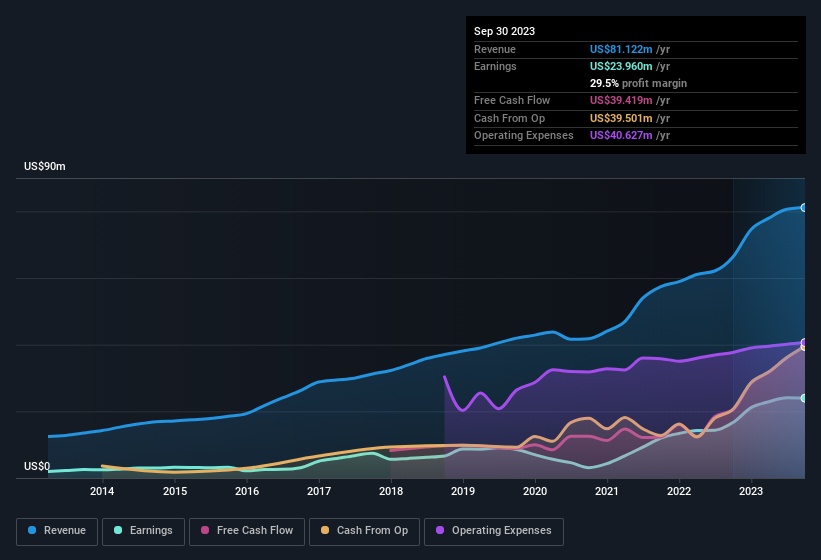

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of California BanCorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note California BanCorp achieved similar EBIT margins to last year, revenue grew by a solid 22% to US$81m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of California BanCorp's forecast profits?

Are California BanCorp Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Over the last 12 months California BanCorp insiders spent US$128k more buying shares than they received from selling them. Shareholders who may have questioned insiders selling will find some reassurance in this fact. It is also worth noting that it was President Thomas Sa who made the biggest single purchase, worth US$72k, paying US$14.30 per share.

On top of the insider buying, it's good to see that California BanCorp insiders have a valuable investment in the business. As a matter of fact, their holding is valued at US$21m. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 10% of the shares on issue for the business, an appreciable amount considering the market cap.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because California BanCorp's CEO, Steve Shelton, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like California BanCorp with market caps between US$100m and US$400m is about US$1.5m.

The California BanCorp CEO received US$877k in compensation for the year ending December 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add California BanCorp To Your Watchlist?

For growth investors, California BanCorp's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with California BanCorp , and understanding it should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of California BanCorp, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance