Here's Why You Should Give Emerson (EMR) Stock a Shot Now

Emerson Electric Co. EMR is poised for growth on the back of healthy demand across end markets and improving supply chains. The company’s restructuring actions highlight its aim to become a pure-play global automation company to drive growth and profitability. EMR’s efforts to consistently reward shareholders through dividends and share buybacks hold promise.

Let’s delve deeper to unearth the factors that make this Zacks Rank #2 (Buy) company a good investment choice.

End-Market Strength: Strong demand in the process and hybrid markets is boosting Emerson’s underlying orders (up 7% in the fiscal second quarter). The Intelligent Devices business unit is benefiting from underlying sales growth in the Americas region. Revenues from the unit increased 6% year over year in the first six months of fiscal 2023.

Strength in the process end markets augurs well for EMR’s Software and Control business group. This, coupled with contribution from the AspenTech acquisition, drove segmental revenues by 30% year over year in the first six months of fiscal 2023.

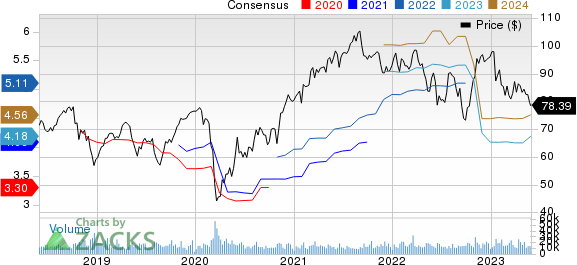

Emerson Electric Co. Price and Consensus

Emerson Electric Co. price-consensus-chart | Emerson Electric Co. Quote

Bullish Forecast: Given the strength across its end markets, Emerson has raised its fiscal 2023 guidance. For fiscal 2023, the company expects net sales to increase 9-10.5% compared with a rise of 8-10% anticipated earlier. Underlying sales are expected to increase 8.5-10% compared with 6.5-8.5% rise estimated earlier. Adjusted earnings are predicted to be between $4.15 and $4.25 compared with $4.00–$4.15 forecasted earlier.

For the fiscal third quarter, EMR expects underlying sales to increase 10-12%. Net sales are predicted to increase 10.5-12.5% year over year in the fiscal third quarter. Adjusted earnings are estimated to be in the band of $1.07-$1.11 per share for the fiscal third quarter. The mid-point of the guided range — $1.09 — indicates an increase of 18% from the year-ago reported number.

Inorganic Activities: Acquisitions have been Emerson's preferred mode of business expansion so far. The acquisition of Fluxa (July 2022) has enabled EMR to leverage the former’s PKM software, its DeltaV control system and life sciences automation software to provide customers with a comprehensive line of solutions for developing new drugs.

In May 2022, Emerson merged its industrial software businesses, OSI Inc. and Geological Simulation Software, with Aspen Technology to create “AspenTech”. The merger, in which the company has majority ownership, enabled it to gain control over a high-valued pure-play industrial software leader, expedite its software strategy and realize substantial synergies.

As part of its restructuring actions, Emerson has lately been aiming to divest non-core/non-profitable businesses. In November 2022, the company completed the divestment of its InSinkErator business to Whirlpool. The divestiture helps the company divert resources to key growth areas. In October 2022, the company divested its majority stake in its Climate Technologies business. The divestment allows the company to become a pure-play global automation company.

Deal to Acquire National Instruments: Emerson’s move to acquire National Instruments in an $8.2 billion deal is aligned with its focus on global automation to drive growth and profitability. The acquisition, expected to be completed in the first half of fiscal 2024, will strengthen EMR’s global automation foothold, helping the company expand into high-growth end markets, including semiconductor and electronics, transportation and electric vehicles and aerospace and defense.

Apart from expanding automation capabilities, the acquisition will open up industrial software opportunities for EMR. Emerson expects the transaction to generate cost savings of $165 million by the end of the fifth year upon completion. The buyout is expected to be immediately accretive to EMR’s adjusted earnings. The acquisition will also generate significant recurring revenues and improve EMR’s gross margins.

Shareholder-Friendly Activities: Strong cash flows (free cash flow was up 23% in the first six months of fiscal 2023) allow Emerson to effectively deploy capital to make acquisitions, repurchase shares and pay out dividends. In October 2022, the company hiked its quarterly dividend rate by 1%. In the first quarter of fiscal 2023, the company completed its target to buyback $2 billion worth of shares in fiscal 2023.

In the first six months of fiscal 2023, EMR paid dividends of $603 million. For 2023, the company expects to pay out dividends of approximately $1.2 billion. The company expects a free cash flow of $2.2 billion for fiscal 2023.

Northbound Estimate Revision: The Zacks Consensus Estimate for Emerson’s fiscal 2023 earnings has been revised upward by 2.7% in the past 60 days.

Other Stocks to Consider

Some other top-ranked stocks within the broader Industrial Products sector are as follows:

Flowserve FLS currently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 2.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Flowserve has an estimated earnings growth rate of 64.5% for the current year. The stock has gained 7.6% in a year.

Graco Inc. GGG presently sports a Zacks Rank #1 at present. The company pulled off a trailing four-quarter earnings surprise of 7.9%, on average.

Graco has an estimated earnings growth rate of 16.3% for the current year. The stock has gained 22.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance