Here's Why You Should Hold FLEETCOR (FLT) in Your Portfolio

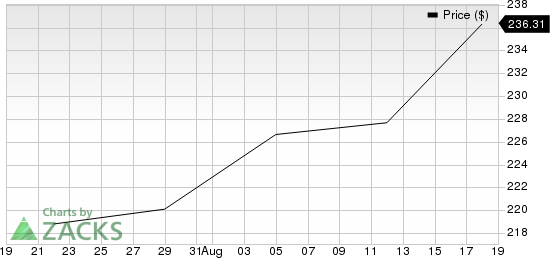

FLEETCOR Technologies, Inc.’s FLT shares have gained 7.9% in the past month compared with a 3.7% rise in the industry it belongs to.

The company has an expected long-term (three to five years) earnings per share growth rate of 14.2%. Its earnings are expected to register growth of 20.8% in 2022 and 9.9% in 2023.

FleetCor Technologies, Inc. Price

FleetCor Technologies, Inc. price | FleetCor Technologies, Inc. Quote

Factors That Bode Well

FLEETCOR’s top line continues to grow organically, driven by continued strong sales, robust retention levels and healthy same-store sales. The company’s organic revenue growth was 17% in the first quarter of 2022.

Acquisitions, over time, have helped FLEETCOR expand its customer base, headcount and operations. The recent acquisition of Accrualify is expected to strengthen the company’s portfolio of payments solutions, and its corporate payments platform capabilities. The acquisition of Global Reach Group is expected to strengthen FLEETCOR’s global position as a non-bank cross-border provider by increasing its scale of payments.

FLEETCOR has a track record of returning value through share repurchases. In 2021, 2020 and 2019, it repurchased shares worth $1.4 billion, $849.9 million and $694.9 million, respectively.

Some Risks

FLEETCOR has more long-term debt outstanding than cash. Cash and cash equivalent balance at the end of second-quarter 2022 was $2.4 billion against a long-term debt level of $4.8 billion.

Zacks Rank and Stocks to Consider

FLEETCOR currently carries a Zacks Rank #3 (Hold).

Investors interestedin the broader Zacks Business Services sector can also consider stocks like Avis Budget Group, Inc. CAR, Genpact Limited G and CRA International, Inc. CRAI.

Avis Budget sports a Zacks Rank #1 (Strong Buy) at present. CAR has an earnings growth rate of 108.4% for the year 2022. You can see the complete list of today’s Zacks #1 Rank stocks here.

Avis Budget delivered a trailing four-quarter earnings surprise of 69.5%, on average.

Genpact carries a Zacks Rank of 2 (Buy) at present. G has a long-term earnings growth expectation of 12.1%.

Genpact delivered a trailing four-quarter earnings surprise of 10.1%, on average.

CRA International currently sports a Zacks Rank #1. CRAI has a long-term earnings growth expectation of 14.3%.

CRAI delivered a trailing four-quarter earnings surprise of 26%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance