Here's Why Holding CME Group (CME) Stock is a Prudent Move

CME Group’s CME compelling product portfolio, global presence, focus on over-the-counter clearing services, effective capital deployment and favorable growth estimates make it worth retaining in one’s portfolio.

CME Group has a decent surprise history, having surpassed earnings estimates in the last eight quarters.

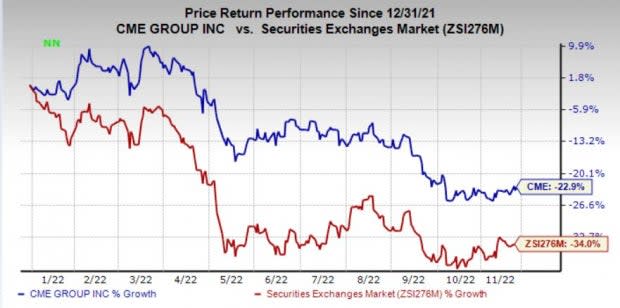

Zacks Rank and Price Movement

CME currently carries a Zacks Rank #3 (Hold). Shares of CME Group have lost 22.9% year to date compared with the industry’s decline of 34%.

Image Source: Zacks Investment Research

Optimistic Growth Projection

The Zacks Consensus Estimate for 2022 earnings is pegged at $7.96, indicating a year-over-year improvement of 19.4% on 7.6% higher revenues of $5 billion. The consensus estimate for 2023 earnings is pegged at $8.31, which indicates a year-over-year improvement of about 4.4% on 2.6% higher revenues of $5.2 billion.

The expected long-term earnings growth rate is pegged at 7.8%.

Northbound Estimate Movement

The consensus estimate for 2022 and 2023 earnings has moved 0.4% and 0.1% north, respectively, in the past 30 days, reflecting analysts’ optimism.

Growth Drivers

This largest futures exchange in the world, in terms of trading volume as well as notional value traded, boasts a solid market presence with a 90% market share of the global futures trading and clearing services. Increasing electronic trading volume adds scalability and hence leverage to CME Group’s operating model.

CME Group’s clearing and transaction fees, contributing the lion’s share to its top line, should continue to benefit from higher trading volumes. Increased volatility continues to fuel trading volumes. Increased adoption of a greater number of crypto assets with increased interest across the entire crypto-economy should add to the upside.

This apart, improving non-transactional revenues should boost the top line.

CME Group’s solid balance sheet and financial flexibility support strategic growth initiatives, including organic market data growth and new product extensions and offerings. CME Group’s effective capital deployment continues to enhance shareholders’ value.

Impressive Dividend History

CME Group has increased dividends at a five-year CAGR (2018-2022) of 8.7%. The dividend yield is 2%, better than the industry average of 1.1%, making the stock an attractive pick for yield-seeking investors.

Stocks to Consider

Some better-ranked stocks from the finance sector are Cboe Global Markets CBOE, W.R. Berkley Corporation WRB and Kinsale Capital Group, Inc. KNSL. While Cboe Global and W.R. Berkley sport a Zacks Rank #1 (Strong Buy), Kinsale Capital carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Cboe Global surpassed earnings estimates in three of the last four quarters and missed in one, the average beat being 4.92%. Year to date, CBOE has lost 4.2%.

The Zacks Consensus Estimate for Cboe Global’s 2022 and 2023 earnings has moved 2.7% and 3.9% north, respectively, in the past 30 days.

The bottom line of W.R. Berkley surpassed estimates in each of the last four quarters, the average being 25.63%. Year to date, the insurer has gained 35.5%.

The Zacks Consensus Estimate for W.R. Berkley’s 2022 and 2023 earnings has moved 5.1% and 2.4% north, respectively, in the past 30 days..

Kinsale Capital’s earnings surpassed estimates in each of the last four quarters, the average being 15.16%. Year to date, Kinsale Capital has gained 28%.

The Zacks Consensus Estimate for KNSL’s 2022 and 2023 earnings implies a respective year-over-year rise of 27.5% and 21.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance