Here's Why Investors Should Avoid iRobot (IRBT) Stock Now

We have issued an updated research report on iRobot Corporation IRBT on Aug 27.

The industrial robot maker currently carries a Zacks Rank #4 (Sell). Its market capitalization is approximately $1.8 billion.

Let’s delve deeper and discuss what led to its poor investment appeal.

Share Price Performances & Over-Valued Stock: Market sentiments have been against iRobot for quite some time now. Its stock price has decreased roughly 31.1% in the past three months compared with the industry’s decline of 8.5%. Also, it is worth noting that shares of the company have lost 31.2% since the release of second-quarter 2019 results on Jul 23, 2019.

The company’s shares currently seem overvalued compared with the industry, using the P/E (TTM) valuation method. The stock’s current multiple is 20.22x, higher than the industry’s multiple of 15.62x. Also, shares of the company are trading above the industry's three-month highest level of 17.15x. This makes us cautious about the stock.

Tariff Woes: The company is currently facing severe headwinds from tariffs imposed by the U.S. government on imports from China and other foreign nations. The Republic-lead administration in the recent past imposed 25% tariffs on China imports, which include robotic vacuum cleaners manufactured in Beijing. The tariff rate is higher than 10% imposed in September 2018.

Higher tariff rates will likely put additional pressure on iRobot’s revenues and earnings. For 2019, tariff-related costs are predicted to be $35-$40 million versus the previously mentioned $20-25 million. Also, revenues are predicted to slightly decline year over year in third-quarter 2019 as tariff woes are expected to adversely impact order activities of some major retailers (including Amazon). Annual projections too have been revised down due to tariff woes (explained below).

Weak Annual Projections: iRobot revised down earnings and revenue predictions for 2019. Earnings are anticipated to be $2.40-$3.15, down from the previously mentioned $3.15-$3.40, whereas, revenues are predicted to be $1.2-$1.25 billion compared with the previously mentioned $1.28-$1.31 billion.

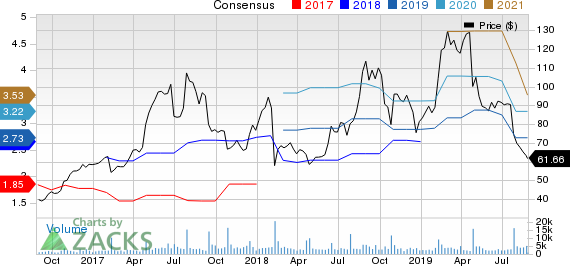

Furthermore, earnings estimates for iRobot for 2019 and 2020 have been lowered in the past 60 days. Currently, the Zacks Consensus Estimate for the company’s earnings is pegged at $2.73 for 2019 and $3.22 for 2020, reflecting declines of 13.6% and 15.3% from the respective 60-day-ago numbers.

iRobot Corporation Price and Consensus

iRobot Corporation price-consensus-chart | iRobot Corporation Quote

Margin-Related Issues: iRobot engages in product marketing and product development to effectively deal with competitive pressures. However, these actions usually require a considerable amount of investments. As noted, the company's gross margin was adversely impacted by promotional and pricing activities in second-quarter 2019.

For 2019, it believes that rise in promotional and pricing activities in EMEA will have adverse impact on results. Gross margin is predicted to be 45-46% in the year, with third-quarter margin likely to be comparable to the second-quarter level and the fourth quarter’s being the lowest in the year.

Stocks to Consider

Some better-ranked stocks in the Zacks Industrial Products sector are Graham Corporation GHM, DXP Enterprises, Inc. DXPE and Dover Corporation DOV. All these stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, earnings estimates for these stocks improved for the current year. Further, earnings surprise for the last reported quarter was 100% for Graham, 4.29% for DXP Enterprises and 0.65% for Dover.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

iRobot Corporation (IRBT) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance