Here's Why Investors Should Hold Marriott Vacations (VAC) for Now

Marriott Vacations Worldwide Corporation VAC is well-poised to benefit from strength in packages, solid summer bookings and the Abound by Marriott Vacations program. However, increased expenses, Maui Wildfires and a fall in Volume Per Guests (VPGs) are headwinds.

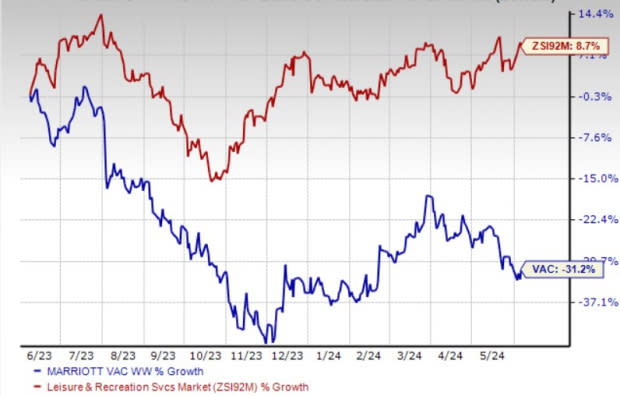

Shares of the company have lost 31.2% in the past year against the industry’s growth of 9.4%. However, in the past six months, VAC’s shares have shown some resilience, rising 11.6% compared with the industry’s growth of 8%. Let’s delve deeper.

Growth Catalysts

Marriott Vacations said that bookings for the upcoming summer season had significantly increased from the prior-year level, both within the country and abroad. The demand for travel to Maui is nearing the pre-wildfires levels, indicating a strong resurgence in tourism. These positive trends are likely to boost its 2024 contract sales by an estimated range of 6-9%.

In 2023, significant developments unfolded within the Hyatt business. The company consolidated 22 Hyatt resorts under the Hyatt Vacation Club brand, simplifying customer interactions. It also unveiled the BEYOND program to provide owners with enhanced vacation options. Moreover, enhancements were made to the preview booking engine. Efforts were also made to phase out ineffective off-premise marketing channels in favor of more efficient branded channels. These initiatives were aimed to drive growth and increase VPGs in the Hyatt Vacation Ownership business, thereby optimizing marketing and sales expenses.

On the development front, the company unveiled plans for two upcoming domestic Westin Vacation Club projects in Charleston and Savannah. This resort would also introduce new sales centers to the market upon its opening in a few years. This apart, emphasis was laid on the debut of Marriott Vacation Club Resort in Waikiki in the latter part of 2024, accompanied by the establishment of a new sales center. Internationally, the company announced an agreement for a 58-unit expansion at one of the existing Marriott Vacation Clubs in Bali, thereby increasing its exposure to nearly 200 units in the region.

This Zacks Rank #3 (Hold) company is actively seeking additional development opportunities in the Asia-Pacific region and the United States. This highlights the effectiveness of co-located developments, which enable shared use of amenities and facilities between the co-located hotel and the new units. In the first quarter, the company announced a new 60-unit Marriott Vacation Club Resort in Thailand, co-branded with an existing JW Marriott, marking the seventh resort in the Asia-Pacific region.

Image Source: Zacks Investment Research

Concerns

VAC has been bearing the brunt of steep expenses for some time now. In the first quarter, total expenses increased 4.2% to $1.1 billion from $1.02 billion reported in the year-ago quarter. Escalated marketing and sales costs and financing expenses affected total costs. Marketing and sales costs came in at $223 million compared with $210 million reported in the prior-year quarter. Financing costs totaled $34 million compared with $26 million in the year-ago quarter.

Although Maui's occupancy has rebounded effectively, rebuilding the sales force is anticipated to be a prolonged process. The company expects to recover a small portion of Maui's lost sales this year, positioning 2024 as a rebuilding phase for the Maui market. The timing of last year's wildfires is expected to lead to a challenging comparison in the first half of this year. The company anticipates the development margin to decline in the second quarter of 2024, owing to the impact of Maui and increased costs.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has risen 45.3% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 58.4% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

AMC Entertainment Holdings, Inc. AMC currently carries a Zacks Rank of 2 (Buy). AMC has a trailing four-quarter earnings surprise of 38%, on average. The stock has risen 81.5% in the past month.

The Zacks Consensus Estimate for AMC’s 2024 EPS implies growth of 70.5% from the year-ago level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Marriott Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance