Here's Why Investors Should Retain Amedisys (AMED) Stock for Now

Amedisys, Inc. AMED is gaining from continued strength in the Hospice business. The company’s earnings in the second quarter of 2022 were ahead of the Zacks Consensus Estimate. The increased utilization of Licensed Practical Nurse (“LPN”) and Physical Therapist Assistant (“PTA”) buoys optimism. However, weak margins and stiff competition does not bode well for the company.

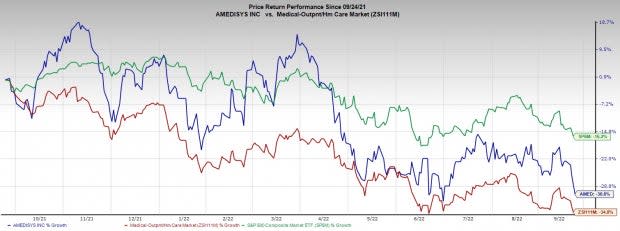

In the past year, the Zacks Rank #3 (Hold) stock has declined 30.6% compared with a 34.8% fall of the industry and a 16.2% drop of the S&P 500.

The renowned home health and hospice service provider has a market capitalization of $3.60 billion. Amedisys’ earnings for the second quarter of 2022 surpassed the Zacks Consensus Estimate by 19.5%.

In the past five years, the company registered earnings growth of 27.3% compared with the industry’s 13.2% rise and the S&P 500’s 13.4% increase. The company’s long-term projected growth of 7.7% compares with the industry’s growth projection of 11.4% and the S&P 500’s expectation of 11.5% growth.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Catalysts

Impressive Q2 Results: Amedisys ended the second quarter with better-than-expected earnings. In Home Health, the company performed 13.2 visits per episode, up 0.2 visits on a sequential basis. On clinical mix, the company achieved 48% LPN utilization and 53% PTA utilization. Within Hospice, same-store admissions grew 6% and the average daily census (“ADC”) was slightly positive at 0.2%. Continued progress on the ADC front is expected to help Amedisys drive performance in the second half of the year.

The Contessa Health acquisition seems to be strategically aligned with Amedisys’ business. Total admissions for hospital and skilled nursing facility (SNF)-at-home were 345, representing a 35% year-over-year growth for Contessa.

Strategic Acquisitions to Add Value: We are optimistic about Amedisys’ latest acquisitions that complement its existing home care and hospice business. In April 2022, the company acquired certain home health assets from AssistedCare Home Health, Inc. and RH Homecare Services, LLC, doing business as AssistedCare Home Health and AssistedCare of the Carolinas, respectively. In the same month, Amedisys acquired Evolution Health to offer home health and hospice services in more communities across Texas, Oklahoma and Ohio.

Management expects the company to have enough cash balance to make several such acquisitions in the future.

Improving Clinical Quality: Amedisys is currently focusing on improving clinical quality. The company has implemented targeted action plans to improve the quality of care for patients. The company’s Home Health Quality of Patient Care Stars score was 4.49 stars for the second quarter, with 100% of care centers reaching 4 stars or greater.

Downsides

Contessa Results Challenged: Despite witnessing favorable growth, Amedisys’ high-acuity care segment, Contessa, was behind budget due to delays in closing scheduled partnerships. This volume represents 35% of the budgeted admissions missed for the second quarter.

Pressure on Margins Remain: Amedisys’ gross margin contracted 196 basis points (bps) to 43.3% in the second quarter. Expenses on salaries and benefits rose 11.7%. Other expenses rose 0.3% year over year. These escalating expenses led to a 474-bps contraction in adjusted operating margin to 10.6%.

Competitive Landscape: The market for home health and hospice is fragmented with several small local providers. With few barriers to entry in this market, Amedisys primarily faces tough competition from local privately and publicly-owned and hospital-owned healthcare providers.

Estimate Trend

In the past 60 days, the Zacks Consensus Estimate for Amedisys’ 2022 earnings has moved north by 0.8% to $5.33.

The Zacks Consensus Estimate for the company’s 2022 revenues is pegged at $2.30 billion, suggesting a 3.9% rise from the 2021 reported number.

Key Picks

A few better-ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corp. MCK.

AMN Healthcare has a long-term earnings growth rate of 3.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.7%, on average. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has lost 9.7% compared with the industry’s 38.8% fall.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has outperformed its industry in the past year. SWAV has gained 16.3% against the industry’s 35.9% fall in the past year.

McKesson has an estimated long-term growth rate of 9.9%. The company surpassed earnings estimates in the trailing three quarters and missed in one, delivering a surprise of 13%, on average. It currently carries a Zacks Rank #2 (Buy).

McKesson has outperformed its industry in the past year. MCK has surged 71.9% against the industry’s 17.5% fall.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amedisys, Inc. (AMED) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance