Here's Why Investors Should Retain Live Nation (LYV) Stock

Live Nation Entertainment, Inc. LYV is likely to benefit from pent-up demand for live events, new client additions, sponsorship and advertising business. However, supply chain disruptions and inflationary pressures are concerns.

Let us discuss the factors highlighting why investors should retain the stock for the time being.

Growth Catalysts

Live Nation benefits from pent-up demand for live events and robust ticket sales. In 2022, the company sold $281 million in fee-bearing tickets, up 28% from 2019. During the year, the company reported 28 million net new fee-bearing tickets, backed by new client additions. It also reported strength in the global non-sports client base, particularly in international markets. Backed by solid consumer demand and increased ticket volume, gross transaction value (GTV) during the year came in at $27.5 billion, up 54% from 2019 levels. The company anticipates increased Live Nation concert ticket sales and additional sales from new clients.

The company is optimistic about its growth in 2023. Robust fan engagement is likely to continue into 2023, as arenas, amphitheaters and stadiums are likely to witness growth in their show count and ticket sales relative to 2019 levels. For concerts, the company said that it has already sold more than 50 million tickets (as of mid-February 2023), up 20% from 2022 levels. In 2023, the company expects to add more venues to its operating portfolio. In terms of tickets, the company is likely to benefit from the market pricing trend. Live Nation Entertainment believes that several of its artists, like Dave Matthews, Luke Bryan, Maroon 5, Travis Scott and Garth Brooks, etc., will have multi-year tours across the United States and Europe. This, in turn, will drive the company’s performance.

The company emphasizes sponsorship and advertising businesses to drive growth. During fourth-quarter 2022, sponsorship and advertising revenues were $245.6 million, up from the prior-year quarter’s $170.3 million. The upside was primarily driven by additional revenues from purchase path integration (with new partners including Google, AWS and Hulu), the restart of an entire festival season and the addition of the Mexico market to its portfolio. In 2022, total revenues from Sponsorship & Advertising business came in at $968.1 million compared with $411.9 million reported in the previous year. Given the strength in consumer demand (for the upcoming shows) and confirmed sponsorship activity (of more than 70%), the momentum is likely to persist in the upcoming periods.

Concerns

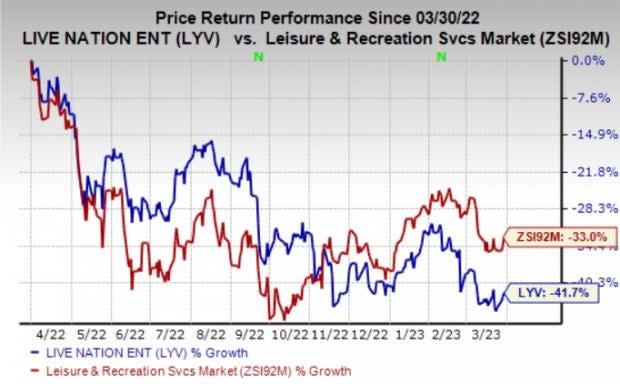

Image Source: Zacks Investment Research

Shares of Live Nation have declined 41.7% in the past year compared with the industry’s 33% fall. Inflationary pressures and supply chain challenges had taken a toll on the company. Also, it has been witnessing a rise in venue costs and service fees. Although the company’s operations continue to recover from the negative impact of the coronavirus crisis, the implications of future disruptions cannot be ruled out.

In 2022, total direct operating expenses came in at $ 12,337.5 million, compared with $4,356 million reported in 2021. Selling, general and administrative expenses in 2022 came in at $2,955.9 million compared with $1,754.8 million reported in 2021. The company is cautious of cost overruns related to the development and expansion of live music venues.

Zacks Rank & Key Picks

Live Nation currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Consumer Discretionary sector are Cedar Fair, L.P. FUN, Hilton Grand Vacations Inc. HGV and Crocs, Inc. CROX.

Cedar Fair sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 64.5%, on average. The stock has declined 16% in the past year.

The Zacks Consensus Estimate for FUN’s 2024 sales and EPS indicates a rise of 2% and 6.5%, respectively, from the year-ago period’s estimated levels.

Hilton Grand Vacations currently sports a Zacks Rank #1. HGV has a trailing four-quarter earnings surprise of 12.1%, on average. Shares of HGV have declined 17.5% in the past year.

The Zacks Consensus Estimate for HGV’s 2023 sales and EPS indicates a rise of 7.1% and 10.8%, respectively, from the year-ago period’s levels.

Crocs sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 21.8%, on average. Shares of Crocs have increased 56.1% in the past year.

The Zacks Consensus Estimate for CROX’s 2023 sales and EPS indicates a rise of 12.5% and 2.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Cedar Fair, L.P. (FUN) : Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance