Here's Why Investors Should Retain McDonald's (MCD) Stock Now

McDonald's Corporation MCD will likely benefit from digital efforts, robust comps growth, and expansion initiatives. Focus on the loyalty program and drive-thru channels have also been driving sales in the last few quarters. Although overall comps have increased sharply, it is still well below the pre-pandemic level in a few markets.

Let’s discuss the factors highlighting why investors should retain the stock for the time being.

Major Growth Drivers

McDonald's has been focusing on digitalization to drive growth. Before the coronavirus crisis, drive-thru accounted for about two-thirds of all sales in the United States. Despite reopening dining rooms, the company stated that drive-thru sales in its top six markets remain strong compared with pre-pandemic levels. The company noted that in its top six markets, digital sales (including the mobile app, kiosks and delivery) were more than 30% of system-wide sales in second-quarter 2022.

McDonald's continues to impress investors with robust comparable sales growth in second-quarter 2022. Global comps advanced 9.7%, while a gain of 40.5% was reported in the prior-year quarter. This marks the sixth consecutive quarter of comps growth. In the first quarter, comps in the United States, international operated markets and international developmental licensed segment rose 3.7%, 13% and 16%, respectively. Japan and Latin America posted robust comps growth. The company reported comps growth for the 27th straight quarter in Japan.

McDonald’s believes there is a huge opportunity to grow all its brands globally by expanding its presence in existing markets and entering new ones. Its expansion efforts continue to drive performance. Despite the pandemic, the company continues to expand its global footprint. It is planning to open more than 1,800 restaurants globally in 2022, including 500 openings in the United States and IOM segment and 1,300 (including nearly 800 in China) inaugurations in the IDL market. The company expects restaurant growth of nearly 3.5% for 2022.

McDonald's continues to focus on the loyalty program to drive sales and average checks. It believes the program will help retain existing customers and expand the customer base. During the second quarter of 2022, the company reported accelerated digital engagement across the markets. The company reported more frequent visits and incremental sales on the back of tailored loyalty messages, a strong lineup of mobile app offers and content offerings. Given a rise in digital adoption, the company remains optimistic and anticipates the initiatives to drive sales and average checks in the upcoming periods. McDonald's currently has loyalty programs in over 50 markets, including France, the U.S., Germany, Australia and Canada.

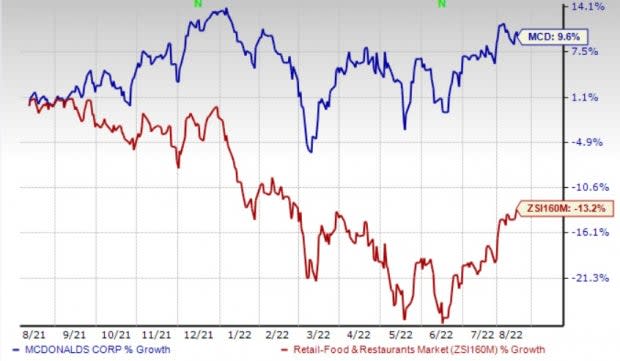

In the past year, shares of McDonald's have gained 9.6% against the industry’s fall of 13.2%.

Image Source: Zacks Investment Research

Concerns

Although overall comps have increased sharply, it is still well below the pre-pandemic level in a few markets. In second-quarter 2022, comps in the China market were negative. Softening economy and COVID-related government restrictions have hurt comps in China.

During the second quarter of 2022, the company announced its exit from the Russian market owing to geopolitical tensions. Also, it cited concerns of a challenging operating environment due to rising inflation, a surge in COVID-19 cases and the return of government restrictions in many markets, exacerbating labor shortages and supply chain challenges. The company stated that rising inflation levels are contributing to weak consumer sentiment worldwide and that the possibility of a global recession cannot be ruled out.

Zacks Rank & Key Picks

McDonald's currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Retail-Wholesale sector are Potbelly Corporation PBPB, Arcos Dorados Holdings Inc. ARCO and Dollar Tree Inc. DLTR.

Potbelly currently carries a Zacks Rank #2 (Buy). PBPB has a trailing four-quarter earnings surprise of 26.2%, on average. Shares of PBPB have declined 25% in the past year.

The Zacks Consensus Estimate for Potbelly’s 2022 sales and EPS suggests growth of 14.1% and 90.4%, respectively, from the corresponding year-ago period’s levels.

Arcos Dorados carries a Zacks Rank #2. ARCO has a long-term earnings growth of 34.4%. Shares of the company have increased 40.2% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2022 sales and EPS suggests growth of 25.7% and 120.8%, respectively, from the year-ago period’s levels.

Dollar Tree carries a Zacks Rank #2, at present. DLTR has a trailing four-quarter earnings surprise of 13.1%, on average. The stock has gained 62.3% in the past year.

The Zacks Consensus Estimate for Dollar Tree’s 2022 sales and EPS suggests growth of 6.7% and 40.5%, respectively, from the corresponding year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance