Here's Why Investors Should Retain Syneos Health (SYNH) For Now

Syneos Health, Inc. SYNH is gaining from strong performances by the Clinical Solutions and Commercial Solutions segments. The continued strength in the company’s SMID customer segment buoys optimism. Robust demand for the company’s high-value solutions ranging from development through commercialization appears promising too. However, mounting costs and foreign exchange headwinds do not bode well.

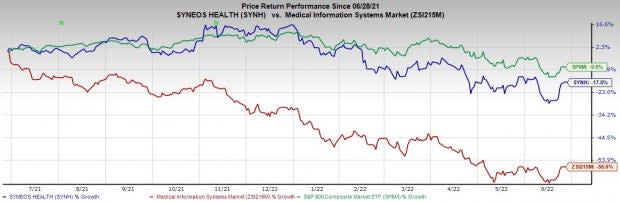

In the past year, the Zacks Rank #3 (Hold) stock has declined 17.8% compared with a 56.6% plunge of the industry and a 9.5% drop of the S&P 500.

The renowned provider of biopharmaceutical outsourcing solutions has a market capitalization of $7.48 billion. Its earnings surpassed estimates in the trailing four quarters, the average surprise being 3.8%.

In the past five years, the company’s earnings have registered 13.7% growth versus the industry’s 17.7% rise and the S&P 500’s 13.4% increase.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors At Play

Impressive Q1 Results: Syneos Health’s first-quarter earnings beat the Zacks Consensus Estimate. The year-over-year improvement in earnings and revenues are impressive. Robust performance by the Clinical Solutions and Commercial Solutions segments is also encouraging. Growth in the Commercial Solutions arm was led by broad-based growth in Deployment Solutions and consulting. Expansion of both margins is an added advantage.

Further, the raised adjusted earnings per share guidance for 2022 instill investors’ confidence.

Clinical Solutions Arm Grows: In the first quarter, the Clinical Solutions segment recorded revenue growth of 8.4% year over year on a reported basis and 9.6% at CER. The upside resulted from balanced growth in the company’s full service and FSP portfolios, including strength in the oncology business. The total growth includes a 100-basis-point contribution from acquisitions and a 240-basis-point headwind from reimbursable expenses, consistent with the updated expectations reflected in the guidance.

The clinical book-to-bill ratio for the reported quarter was 1.22 times, including reimbursable expenses and the impact of related backlog adjustment, which resulted in a trailing 12-month book-to-bill ratio of 1.07 times.

Strong Long-term Potential: Syneos Health remains confident about the long-term strength of its business. During the first-quarter earnings call, the company noted that the demand for high-value solutions from development through commercialization remains healthy, with robust new business pipelines across the organization. The company continues to witness sustained strong demand across all customer segments, including SMID customers.

In addition, the company continues to witness more opportunities for preferred provider relationships with larger pharma customers as the impacts of the pandemic subside. Strong awards and backlog growth also position Syneos Health for sustained long-term growth.

Downsides

Rising Costs: During the first quarter, the company’s selling, general and administrative (SG&A) expenses rose 2.1% year over year. These escalating expenses are building pressure on Syneos Health’s bottom line.

Strict Regulatory Environment: The biopharmaceutical industry is governed by extremely stringent government regulations in domestic and global markets. Within the Clinical Solutions business, the FDA regulates the clinical trials of drug products in human enrollments, the form and content of regulatory applications. Globally, clinical trials are governed by the laws and regulations of the country where these are conducted.

Forex Woes: Syneos Health has been exposed to fluctuations in foreign currency. The financial statements are reported in U.S. dollars and changes in foreign currency exchange rates could significantly affect the company’s financial condition, results of operations or cash flows.

Estimate Trend

In the past 60 days, the Zacks Consensus Estimate for Syneos Health’s 2022 earnings has moved 1.2% north to $5.14.

The Zacks Consensus Estimate for its 2022 revenues is pegged at $5.66 billion, suggesting an 8.7% rise from the 2021 figure.

Key Picks

A few better-ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, Novo Nordisk NVO and Masimo Corporation MASI.

AMN Healthcare has a long-term earnings growth rate of 1.1%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.6%, on average. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has gained 18.2% against the industry’s 50.8% fall.

Novo Nordisk has a long-term earnings growth rate of 14.5%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 7.6%, on average. It currently flaunts a Zacks Rank #2 (Buy).

Novo Nordisk has outperformed its industry in the past year. NVO has gained 31.2% against the industry’s 19.3% growth.

Masimo has a historical earnings growth rate of 15.1%. Masimo’s earnings surpassed estimates in the trailing four quarters, the average surprise being 4.4%. It currently carries a Zacks Rank #2.

Masimo has underperformed its industry in the past year. MASI has declined 44.2% compared with the industry’s 25.6% plunge.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk AS (NVO) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Syneos Health, Inc. (SYNH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance