Here's Why Investors Should Steer Clear of MDC Stock Now

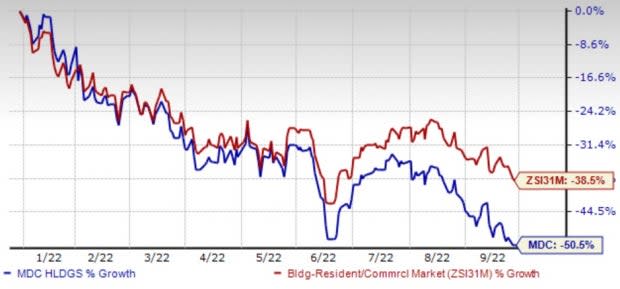

M.D.C. Holdings, Inc.’s MDC shares plunged 50.5% this year compared with the Zacks Building Products - Home Builders industry’s 38.5% decline. The overall industry has been grappling with supply chain disruptions and labor and raw material shortages. Also, rising inflation, particularly for materials and transportation, the Fed’s interest rate hikes and affordability issues are adding to the woes.

Although MDC and its peers like KB Home KBH, D.R. Horton, Inc. DHI and Lennar Corporation LEN have undertaken various price actions as well as cost-saving moves, they are witnessing reduced demand and project delays.

Analysts are pessimistic about MDC’ near-term prospects, as evident from the recent estimate revision trend. Earnings estimates for the third quarter and 2022 have fallen in the past month. The Zacks Consensus Estimate for earnings has decreased 6.3% and 4.5% for both the said periods, respectively. This reflects 12.6% earnings growth on just an 8% revenue rise for third quarter. For 2022, earnings estimates reflect 17.6% improvement on 8.2% revenue increase. For 2023, the situation is likely to worsen, as evident from 27.7% earnings decline over 2022 for a 7.3% revenue decrease.

Image Source: Zacks Investment Research

Let’s check out the factors insisting investors to sell MDC — a Zacks Rank #4 (Sell) — stocks now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

What Makes MDC a Sell Rated Stock?

Fed’s Back-to-Back Interest Rate Hikes to Deal Inflation

The housing industry is cyclical and affected by consumer confidence levels, prevailing economic conditions and interest rates. Currently, the Fed's determination to curtail inflation through interest rate increases and quantitative tightening has started to show the desired effect of slowing down sales in some markets across the country.

In September, the Fed approved its third consecutive interest-rate rise of 0.75 percentage points and signaled additional large increases were likely at upcoming meetings as it combats inflation that remains near a 40-year high. The rate hike brings the central bank’s benchmark interest rate, the federal funds rate, to a new range of 3.0% to 3.25% — its highest level since 2008 — from a range between 2.25% and 2.5%. Officials expect the Fed funds rate to rise to 4.4% by the end of 2022 and 4.6% by the end of 2023. Hence, it increased by 3.4% for this year and 3.8% previously.

Above 6% Mortgage Rates Hurt Buyers Intention

The highly interest-rate-sensitive housing sector in the United States has been significantly impacted by the rising mortgage rates as the Fed made an aggressive move to bring down the high inflation by lifting borrowing costs. Interest rate hikes, soaring inflation and a smaller bond-buying program are hitting the affordability of the prospective buyers.

The recent Freddie Mac’s Primary Mortgage Market Survey shows that the 30-year fixed mortgage rate has gone up to 6.29% for the week ending Sep 22. This marks the highest reading since 2008 and more than double the year-ago figure. Mortgage activity declined 3.7% for the week ending Sep 23 from the previous week, per the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey.

Low Orders, Deliveries & Backlogs

Due to lower demand from higher mortgage interest rates, inflation and other macroeconomic and geopolitical concerns, MDC experienced a year-over-year decline in deliveries and net orders during the second quarter.

Units delivered were down 7% from the year-ago level to 2,536 homes. Net new orders fell 29% from the prior-year quarter to 2,237 homes. The value of net orders also declined 40% from the year-ago quarter’s levels to $882.1 million, despite a 16% higher ASP of net orders. Cancellations, as a percentage of beginning backlog, increased 400 basis points to 9.7% from 5.7%.

Quarter-end backlog totaled 7,426 homes, down 3% from a year ago. Potential housing revenues from backlog rose 8% from the prior-year period’s levels to $4.44 billion on a 12% higher ASP of homes in backlog.

For third-quarter 2022, the company expects home deliveries of between 2,200 and 2,500 units. This indicates a decline from 2,419 units reported in third-quarter 2021 (considering the mid-point of the guidance).

Supply-Chain Bottlenecks & Inflation

MDC has been witnessing challenges related to supply chain issues, material shortages and municipal delays. Raw material inflation is eating into homebuilders’ margins. Labor shortages are resulting in higher wages and delays in construction, which eventually hurts the number of homes delivered. In addition, the rising lumber prices could dampen housing market momentum. There is a lot of variability in lumber prices that are building cost pressure. The increase was mainly due to insufficient domestic production and tariffs on Canadian sources.

A Brief Discussion of Above-Mentioned Stocks

KB Home, a Zacks Rank #5 (Strong Sell) company, recently reported mixed results in third-quarter fiscal 2022 (ended Aug 31, 2022), with earnings surpassing the Zacks Consensus Estimate and revenues missing the same.

On a year-over-year basis, KBH’s earnings and revenues increased, despite prevailing industry headwinds and moderate housing demand, given the solid backlog level.

D.R. Horton, a Zacks Rank #4 (Sell) stock, is expected to witness a 41.4% year-over-year improvement in fiscal fourth-quarter earnings. Also, revenues are likely to gain 25.9% from the prior-year levels.

However, DHI’s earnings per share are expected to register a 20.7% decline in fiscal 2023 after the expected 49.7% growth in fiscal 2022.

Lennar, a Zacks Rank #3 (Hold) company, also reported its third-quarter fiscal 2022 (ended May 31, 2022) results, wherein quarterly earnings topped the Zacks Consensus Estimate but revenues missed the same amid rising interest rates.

Pertaining to the quarterly release, Stuart Miller, executive chairman of Lennar, said, "While our new orders declined 12% compared to last year's third quarter, we continued to maintain a consistent starts pace and drive sales by adjusting pricing and incentives. Sales have clearly been impacted by rising interest rates, but there remains a significant national shortage of housing, especially workforce housing, and demand remains strong as we navigate the rebalance between price and interest rates."

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KB Home (KBH) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance