Here's Why MDA Space (TSE:MDA) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in MDA Space (TSE:MDA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide MDA Space with the means to add long-term value to shareholders.

View our latest analysis for MDA Space

How Fast Is MDA Space Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. MDA Space's EPS skyrocketed from CA$0.29 to CA$0.39, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 36%.

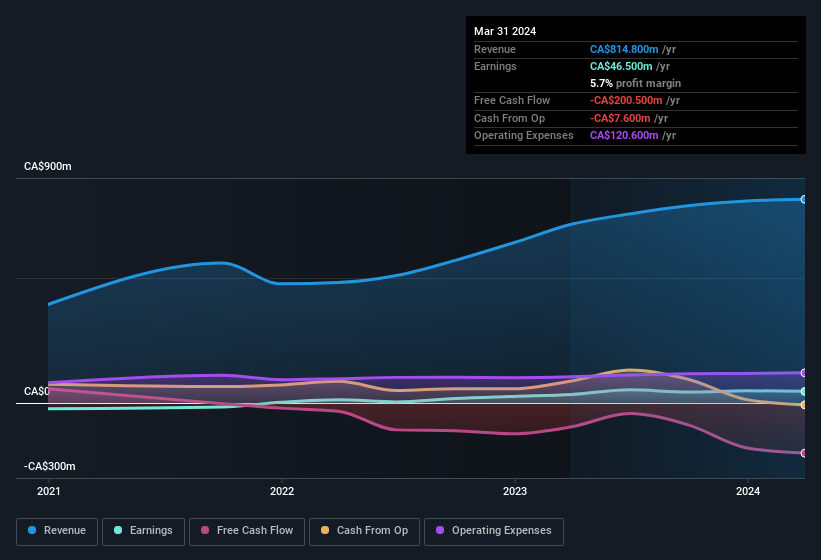

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, MDA Space's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of MDA Space's forecast profits?

Are MDA Space Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no MDA Space insiders reported share sales in the last twelve months. But the important part is that Independent Chairman of the Board Brendan Paddick spent CA$386k buying stock, at an average price of CA$11.95. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

The good news, alongside the insider buying, for MDA Space bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$25m worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 1.7%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does MDA Space Deserve A Spot On Your Watchlist?

For growth investors, MDA Space's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. These things considered, this is one stock worth watching. It is worth noting though that we have found 1 warning sign for MDA Space that you need to take into consideration.

The good news is that MDA Space is not the only stock with insider buying. Here's a list of small cap, undervalued companies in CA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance