Here's Why MercadoLibre (NASDAQ:MELI) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like MercadoLibre (NASDAQ:MELI), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for MercadoLibre

MercadoLibre's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that MercadoLibre grew its EPS from US$1.57 to US$5.39, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

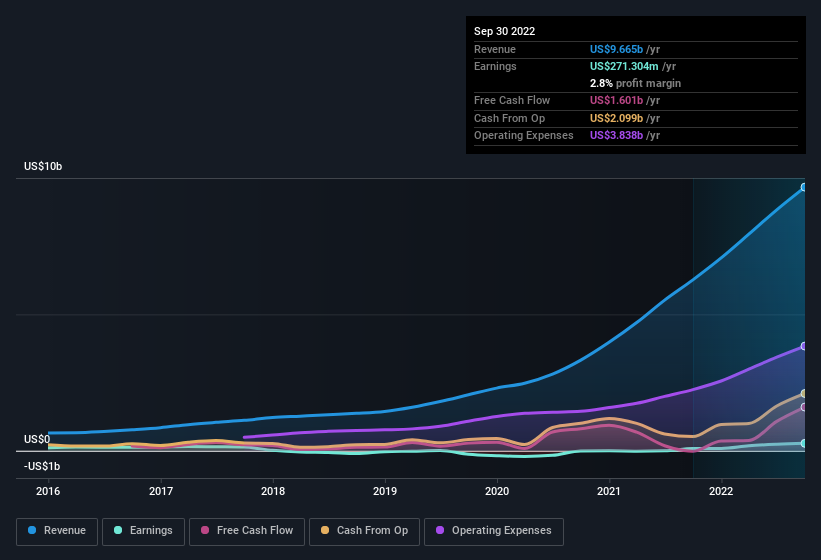

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for MercadoLibre remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 54% to US$9.7b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for MercadoLibre.

Are MercadoLibre Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In the last year insider at MercadoLibre were both selling and buying shares; but happily, as a group they spent US$174k more on stock, than they netted from selling it. On balance, that's a good sign. We also note that it was the Executive VP of Corporate Affairs & President of Argentina, Juan De La Serna, who made the biggest single acquisition, paying US$201k for shares at about US$939 each.

The good news, alongside the insider buying, for MercadoLibre bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth US$134m. This comes in at 0.3% of shares in the company, which is a fair amount of a business of this size. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Should You Add MercadoLibre To Your Watchlist?

MercadoLibre's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe MercadoLibre deserves timely attention. What about risks? Every company has them, and we've spotted 1 warning sign for MercadoLibre you should know about.

The good news is that MercadoLibre is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance