Here's Why Pfeiffer Vacuum Technology (FRA:PFV) Can Manage Its Debt Responsibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Pfeiffer Vacuum Technology AG (FRA:PFV) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Pfeiffer Vacuum Technology

How Much Debt Does Pfeiffer Vacuum Technology Carry?

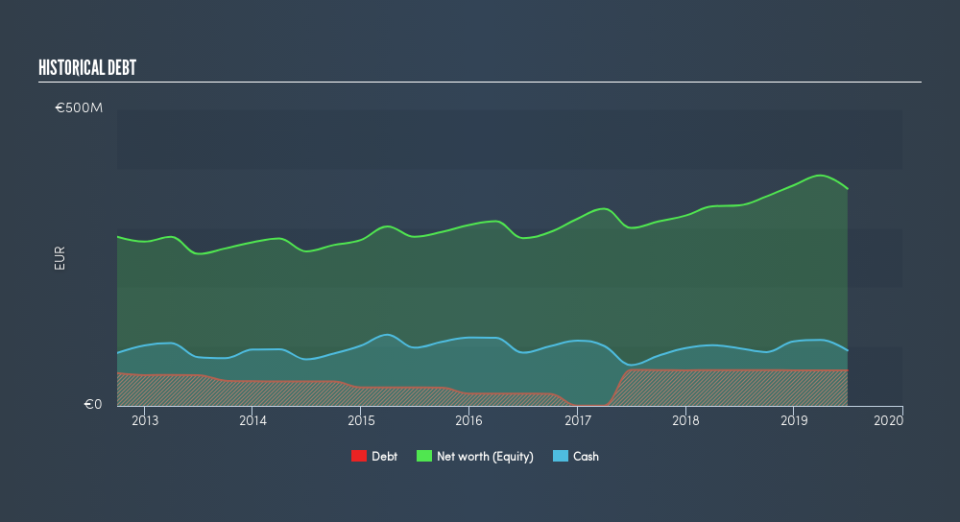

As you can see below, Pfeiffer Vacuum Technology had €60.0m of debt, at June 2019, which is about the same the year before. You can click the chart for greater detail. However, its balance sheet shows it holds €93.7m in cash, so it actually has €33.7m net cash.

How Healthy Is Pfeiffer Vacuum Technology's Balance Sheet?

According to the last reported balance sheet, Pfeiffer Vacuum Technology had liabilities of €121.7m due within 12 months, and liabilities of €141.0m due beyond 12 months. On the other hand, it had cash of €93.7m and €97.7m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €71.4m.

Since publicly traded Pfeiffer Vacuum Technology shares are worth a total of €1.29b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Pfeiffer Vacuum Technology also has more cash than debt, so we're pretty confident it can manage its debt safely.

On the other hand, Pfeiffer Vacuum Technology's EBIT dived 11%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Pfeiffer Vacuum Technology's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Pfeiffer Vacuum Technology may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Pfeiffer Vacuum Technology produced sturdy free cash flow equating to 51% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Pfeiffer Vacuum Technology has €34m in net cash. So we are not troubled with Pfeiffer Vacuum Technology's debt use. Over time, share prices tend to follow earnings per share, so if you're interested in Pfeiffer Vacuum Technology, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance