Here's Why Proteome Sciences (LON:PRM) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Proteome Sciences (LON:PRM). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Proteome Sciences

Proteome Sciences' Improving Profits

In the last three years Proteome Sciences' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, Proteome Sciences' EPS soared from UK£0.0013 to UK£0.0019, over the last year. That's a fantastic gain of 45%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Proteome Sciences shareholders can take confidence from the fact that EBIT margins are up from 12% to 15%, and revenue is growing. Both of which are great metrics to check off for potential growth.

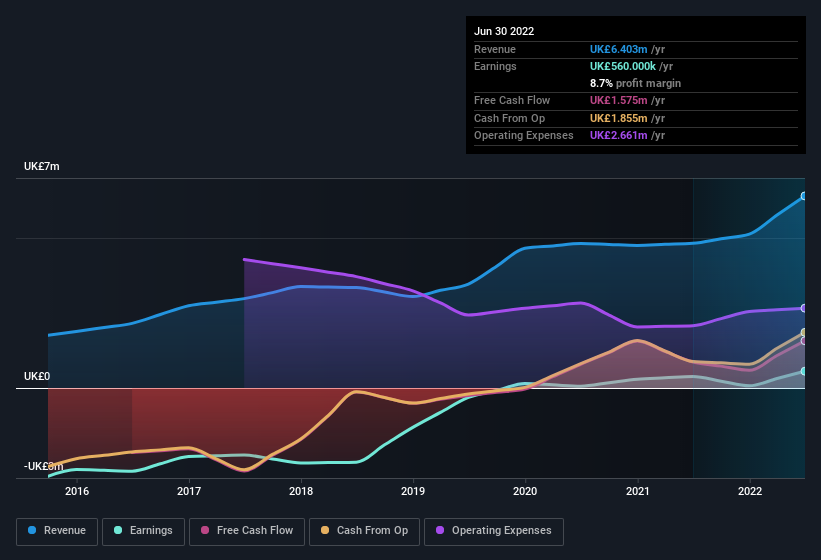

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Proteome Sciences is no giant, with a market capitalisation of UK£11m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Proteome Sciences Insiders Aligned With All Shareholders?

Is Proteome Sciences Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Proteome Sciences' strong EPS growth. Even so, be aware that Proteome Sciences is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance