Here's Why You Should Retain Centene (CNC) Stock for Now

Centene Corporation’s CNC improving medical membership, growing revenues, pursuit of buyouts, numerous contract wins, partnerships, and continued data-driven innovation make it worth retaining in one’s portfolio. Also, its favorable growth estimates are confidence boosters for investors.

The company is one of the largest Medicaid health insurers in the United States, catering to more than 14 million Medicaid recipients in 30 states as of 2023-end. CNC provides access to high-quality healthcare, health solutions and innovative programs that help families stay healthy.

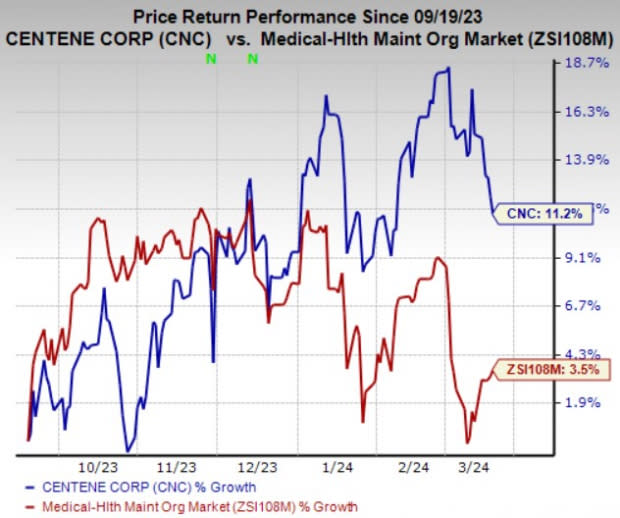

Zacks Rank & Price Performance

CNC currently carries a Zacks Rank #3 (Hold). In the past six months, the stock has gained 11.2% compared with the industry’s rise of 3.5%.

Image Source: Zacks Investment Research

Rising Estimates

The Zacks Consensus Estimate for CNC’s 2024 earnings per share (EPS) is pegged at $6.75, indicating a 1.1% increase from the year-ago reported figure of $6.68. The same for 2025 EPS is pegged at $7.57, suggesting a 12.1% increase from the year-ago estimated figure.

The company beat earnings estimates in three of the past four quarters and missed once, the average surprise being 7.1%.

Key Drivers

Centene’s total revenues are expected to benefit from Medicaid membership growth, several acquisitions, growth in Medicare business and expansion into new states. This figure is expected to grow further as the company continues to grow its operations organically and inorganically through buyouts. Centene also estimates 2024 adjusted EPS to be a minimum of $6.70, suggesting a 0.3% increase from the 2023 reported level.

Centene specializes in providing health services to Medicaid and Medicare recipients. Its total membership increased 1.5% in 2023. Centers for Medicare & Medicaid Services estimates the total Medicaid market to grow $1.1 trillion by 2029. In addition, Medicaid spending is expected to increase 5.6% annually through 2031. Premium and service revenues are currently predicted to be between $134.5 billion and $137.5 billion in 2024. The company’s Marketplace business is expected to remain a tailwind in 2024, and its Ambetter franchise will continue to provide opportunities to serve a large and growing addressable market.

We expect investment income to rise 8.9% in 2023. Riding on increasing interest rates, investment income should continue to rise.

CNC does not shy away from grabbing opportunities to grow inorganically through buyouts and partnerships. CNC also believes in streamlining its business to focus on its core areas. It divested Circle Health Group to intensify its focus on growing its Managed Care business. Disciplined executions like this will result in reduced distraction and better performance in the future.

Centene is expanding into new markets through numerous contract wins. CNC will expand its Medicaid business in North Carolina from late 2023 and will strengthen its relationship with the state. CNC will be providing managed care for Oklahoma Health Care Authority’s SoonerSelect and SoonerSelect Children’s Specialty programs. Moreover, the company aims to introduce its Medicare Advantage plans in 21 new counties in 2024. CNC was awarded a managed care contract in January 2024 to serve members of New Hampshire’s Medicaid program. All these moves will fuel growth in the form of more premium and service revenues in the future.

CNC is executing well on its value-creation plan, which aims to drive margin expansion through profitable growth. The company has been expanding the use of CATA, its proprietary tool, to reduce provider abrasion. CNC’s Medicare brand, Wellcare’s pharmacy benefit manager, will be Express Scripts for 2024, providing cost savings for members. This is a major milestone achieved under the value creation plan, which positions it to generate significant value for shareholders. The company also continues to streamline the organization through portfolio rationalization. Centene collaborated with Reinvestment Partners in February 2024 to provide its Medicaid members with access to a monthly prepaid amount that can be used to buy healthy fruits and vegetables. This move aims to mitigate the impact of chronic diseases, thereby reducing claims costs.

The company manages its excess capital well through share repurchases and debt repayment. It bought back shares worth $27 million in the fourth quarter of 2023. It also focuses on reducing financial leverage by repaying its debts. This should instill confidence in shareholders. The company has a VGM Score of B.

However, CNC’s total expenses rose 10.6% in the fourth quarter of 2023 due to higher medical costs. Rising costs can trim its margins. Centene’s return on equity (ROE) undermines its growth potential. The company’s trailing 12-month ROE of 14.3% compares unfavorably with the industry average of 23.3%, indicating that it is less efficient in utilizing its shareholders’ funds. Nevertheless, we believe that a systematic and strategic plan of action will drive growth in the long term.

Stocks to Consider

Some better-ranked stocks in the Medical space are Organon & Co. OGN, The Ensign Group, Inc. ENSG and The Cigna Group CI. While Organon currently sports a Zacks Rank #1 (Strong Buy), Ensign Group and Cigna carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Organon’s earnings surpassed the Zacks Consensus Estimate in two of the last four quarters and missed the mark twice, the average surprise being 5%. The Zacks Consensus Estimate for OGN’s earnings indicates a rise of 3.6%, while the consensus mark for revenues suggests an improvement of 1% from the corresponding year-ago reported figures.

The consensus estimate for OGN’s 2024 earnings has moved 1.2% north in the past 30 days. Shares of Organon have gained 26.8% year to date.

Ensign Group’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 1.7%. The Zacks Consensus Estimate for ENSG’s 2024 earnings indicates a rise of 12.2% from the year-ago reported figure. The consensus mark for revenues indicates growth of 11.2% from the year-ago reported figure.

The consensus estimate for ENSG’s 2024 earnings has moved 0.6% north in the past 30 days. Shares of Ensign Group have gained 9.3% year to date.

Cigna’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 2.9%. The Zacks Consensus Estimate for CI’s 2024 earnings indicates a rise of 13%, while the consensus mark for revenues suggests an improvement of 20.4% from the corresponding year-ago reported figures.

The Zacks Consensus Estimate for CI’s 2024 earnings has moved 0.3% north in the past 60 days. Shares of Cigna have rallied 17.6% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cigna Group (CI) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

Organon & Co. (OGN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance