Here's Why You Should Retain Crown Holdings (CCK) Stock Now

Crown Holdings, Inc. CCK is gaining from forecast-beating first-quarter 2022 results. Solid global beverage-can demand on consumers’ strong preference for cans over other packaging formats is driving growth. The company is focused on investments in the construction of new can plants and the addition of new production lines to existing facilities to capitalize on this demand trend.

Earnings & Sales Surpass Q1 Estimates: Crown Holdings’ first-quarter 2022 adjusted earnings per share (EPS) of $2.01 beat the Zacks Consensus Estimate of $1.82 and increased 9.8% year over year. Revenues of $3,162 million surpassed the Zacks Consensus Estimate of $3,011 million and rose 23% year over year.

Positive Earnings Surprise History: Crown Holdings, a Zacks Rank #3 (Hold) company, has a trailing four-quarter earnings surprise of 9.8%, on average.

Return on Equity (ROE): Crown Holdings’ trailing 12-month ROE of 39.6% emphasizes its growth potential. The company’s ROE is higher than the industry’s ROE of 27.7%, highlighting its efficiency in utilizing shareholders’ funds.

Positive Growth Expectations: The company’s earnings estimate for the current year is pegged at $8.18, suggesting year-over-year growth of 6.8%.

Upbeat View: Crown Holdings projects second-quarter 2022 adjusted EPS between $2.00 and $2.10. For the current year, the company anticipates adjusted EPS in the range of $8.00-$8.20. In 2021, the company reported an adjusted EPS of $7.66. Higher food can volumes, improved equipment deliveries and the contractual pass-through of cost inflation will aid the company’s bottom-line results in the current year.

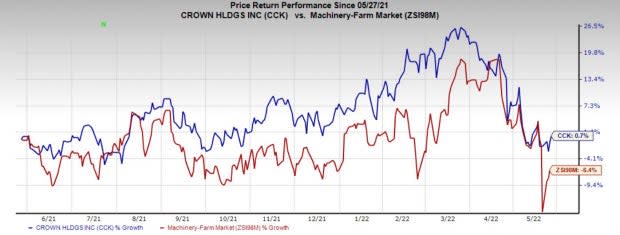

Price Performance: Crown Holdings’ shares have moved up 0.7% in the past year against the industry’s fall of 6.4%.

Image Source: Zacks Investment Research

Other Growth Drivers

In the past few years, beverage cans demand has been growing as it is the world’s most sustainable and recycled beverage packaging. An estimated 75% of new beverage product launches are now in cans. Crown Holdings is focused on growing its global beverage can business on the back of this strong demand trend. Demand will continue to outstrip supply in most global markets for the foreseeable future. North America, Europe and Mexico are experiencing higher volumes and market expansion on increased beverage consumption. CCK continues to implement several expansion projects, including the construction of new plants and the addition of production lines to existing facilities to meet escalating can demand.

In North America, beverage can growth has been on the rise in recent years as new beverage products are being introduced in cans compared with other packaging. In the March-end quarter, the company continued to benefit from strong performances in the North American Tinplate, can-making equipment businesses and a robust beverage can shipments volume. This momentum will continue in the second quarter and throughout the year. Crown Holdings completed construction on four production lines across the Americas Beverage segment in. The segment is set to commercialize an additional seven lines in 2022 and 2023.

Crown Holdings’ Transit Packaging segment is likely to benefit from continued volume growth, efficiency gains and cost improvements in 2022. Increased food can volumes, higher beverage can equipment deliveries and contractual recovery of inflation will aid the segment income.

Crown Holdings is focused on disciplined pricing, cost control and capital allocation. The company's primary capital-allocation focus will be to reduce leverage while still investing in its business. It continues to pursue growth opportunities through capacity additions to existing plants, new plants in existing markets, strategic acquisitions in geographic areas and product lines and making share repurchases.

Crown Holdings continues to bear the brunt of supply chain headwinds and inflated costs for freight services. These might unfavorably impact its margins.

Stocks to Consider

Some better-ranked stocks in the Industrial Products sector are Graphic Packaging Holding Company GPK, Myers Industries MYE and Packaging Corporation of America PKG. While GPK and MYE flaunt a Zacks Rank #1 (Strong Buy), PKG carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Graphic Packaging has an estimated earnings growth rate of 86.8% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 7.6%.

Graphic Packaging pulled off a trailing four-quarter earnings surprise of 7.2%, on average. The company’s shares have appreciated 14.8% in a year.

Myers Industries has an expected earnings growth rate of 67% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 27% in the past 60 days.

MYE has a trailing four-quarter earnings surprise of 20.1%, on average. Myers Industries’ shares have gained 13% in the past year.

Packaging Corporation has an expected earnings growth rate of 16.2% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 4.2% in the past 60 days.

PKG has a trailing four-quarter earnings surprise of 19.6%, on average. Packaging Corporation’s shares have gained 4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

Crown Holdings, Inc. (CCK) : Free Stock Analysis Report

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

Myers Industries, Inc. (MYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance